Art Basel Hong Kong cancelled after spread of the coronavirus

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Art Basel has finally confirmed the decision to cancel its eighth edition in Hong Kong, due to take place between March 19 and 21, as the spread of the coronavirus left it with “no option”, a statement says. The virus was declared a global health emergency by the World Health Organization at the end of January and is so far responsible for over 600 deaths. Many committed exhibitors felt that the fair should have made its decision earlier, given the logistics of getting their works to Hong Kong, though their frustration partly reflects the fact that there had been calls from some western galleries to postpone the fair even before the outbreak of the coronavirus, on the back of the city’s political unrest since the summer. Nevertheless, about 240 galleries had signed up for the March event in Hong Kong’s Convention and Exhibition Centre. A spokeswoman for the fair, which is owned by the Swiss-exchange listed events company MCH Group, confirms that committed exhibitors will get a 75 per cent refund on their booth fees and that the fair itself will file an insurance claim.

Art Basel’s decision has triggered the cancellation of satellite events. These include the nearby fair Art Central, which had 80 confirmed participants for its Hong Kong Harbourfront tent, while Christie’s has postponed a new contemporary and Modern art auction that had been planned to coincide with Art Basel on March 19.

Three paintings that were restituted to the heirs of the Jewish businessman and collector Gaston Lévy anchored Sotheby’s London auction of Impressionist, Modern and Surrealist art on Tuesday.

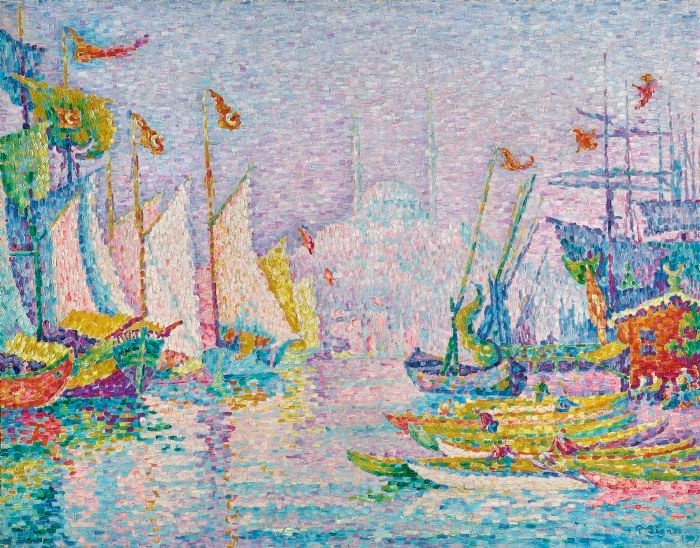

Leading the group was Camille Pissarro’s “Gelée blanche, jeune paysanne faisant du feu” (1887-88), which sold for £11.5m (£13.3m with fees, est £8m-£12m), the highest price of the evening. Paul Signac’s bright “La Corne d’Or. Matin” (1907) then sold for £6.5m (£7.6m with fees, est £5m-£7m) while another pointillist Signac, “Quai de Clichy. Temps gris” (1887), sold in the room for £1.1m (£1.3m with fees, est £600,000-£800,000).

The works were seized by the Nazis in 1940; one, Signac’s “Quai de Clichy”, was among the hoard found in the homes of Cornelius Gurlitt, the son of a Nazi art dealer, in 2012. The other two works were repatriated to France after the war and were at the Musée d’Orsay in Paris from 2000 until restituted by the French government to the Lévy heirs in 2018. The sale overall made a total £42m (£49.9m with fees, est £41.8m-£59.6m).

Supply is still difficult to secure in this market — Sotheby’s fielded only 33 lots, versus 45 for a fee-inclusive £87.7m last year — but the auction house overcame some of the struggle by finding prime works by less usual names, and pricing them attractively. These included the eerie “Florentine Garden” (1938), by the magical realist Dutch painter Pyke Koch, which sold for £450,000 (£555,000 with fees, est £200,000-£300,000).

Generating nearly as much interest was the presence of Sotheby’s new owner, Patrick Drahi, and his recently installed chief executive, Charles Stewart, who were in the London saleroom for the first time since Sotheby’s sale completed in October.

Christie’s had more material the following night (49 lots in total), and was rewarded for its efforts, particularly when it came to the priciest lots, which sold above their presale estimates. The combined total for the Impressionist and Modern portion and the consecutive Surrealist section of the sale was a within-estimate £91.1m (£106.8m with fees), with the majority spend in the first part of the evening (£62.9m with fees).

There were hopes that a female artist could lead an evening auction in the field this season, and Tamara de Lempicka’s majestic 1932 portrait of the cabaret singer Marjorie Ferry certainly won the day among the Impressionist and Modern works when it sold for £14.25m (£16.3m with fees, est £8m-£12m, third party guarantee). But it was a classic Surrealist painting — René Magritte’s “A la rencontre du plaisir” (1962) — that topped the week, selling for £16.5m (£18.9m with fees, est £8m-£12m, auction house guarantee).

Elsewhere, bidding was also deep for George Grosz’s “Gefährliche Straße” (Dangerous Street, 1918), an anguished snapshot of Berlin painted in the last months of the first world war. This sold for £8.4m (£9.7m with fees, est £4.5m-£6.5m, auction house guarantee). A little lower down the price scale, “Femme à sa toilette” (1889) by the lesser-known Paris avant garde artist Louis Anquetin sold well above its £400,000 to £600,000 estimate for £1.1m (£1.3m with fees).

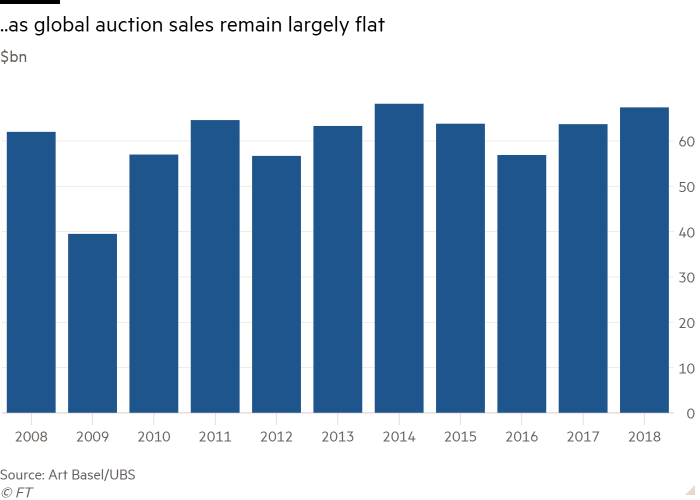

The art market may have been dragged kicking and screaming into ecommerce, but purchasers are increasingly comfortable buying through their screens. Data from the online marketplace Invaluable shows that the share of sales made online grew from 3.5 per cent in 2009 to 11.8 per cent in 2019, a period when growth in the global art market as a whole was flat. “Younger consumers are always on the move, with the expectation that they can access auctions wherever they may be,” said Rob Weisberg, chief executive of Invaluable, speaking at its third Global Auction House Summit (Paris, February 3-5). Numbers from Phillips auction house reflect the trend: the auction house reports that total sales in 2019 fell slightly, from $916.5m in 2018 to $907.9m, while online sales gained 50 per cent to turn over $75m.

Marc Sands, Bonhams chief marketing officer, urged that the art market get more on board with its digital initiatives, noting at the Invaluable conference that “Most industries had this conversation 10 years ago.” The art market has been “really, really slow” to act, partly because of hiring too much from its own field, he said. In 2019, his firm looked well beyond and appointed Chris Tolson as chief technology officer. Tolson had previously worked for 12 years at the gambling firm Bet365.

Sotheby’s Master Paintings day sale in New York on January 30 provided some art market chatter as a once very newsworthy painting came back for sale to little fanfare. The portrait of James Stuart, a Duke at the court of Charles I, catalogued online as by the “Studio of Sir Anthony van Dyck” (1599-1641), was at the centre of a 2002 court case in London. The case was brought by a Texan businessman, Richard Drake, who had bought the painting from London’s Agnews gallery, as a genuine Van Dyck, for £1.5m in 1998 (the equivalent of about $3.5m today). Later aware of the work’s provenance and differences of opinion about its authorship, Drake sought a refund from the gallery but lost his case in the UK’s High Court, which found that Drake’s agent had withheld the pertinent information. Drake died in 2018 and his once-infamous painting sold out of his estate last month for $300,000 ($375,000 with fees).

Sotheby’s main Old Masters sale the previous evening made a within-estimate $50.9m ($61.1m with fees) and was “generally healthy”, says Harry Smith, managing director of the art advisers Gurr Johns. Top lot was an altarpiece by Giovanni Battista Tiepolo, “Madonna of the Rosary with Angels” (1735), which made an auction record for the Venetian artist at $15m ($17.3m with fees). Withdrawn from sale was a 1626-27 painting by Jan Lievens, “Woman Embraced by a Man”, believed to include a portrait of Rembrandt, that had been estimated at $4m-$6m. Sotheby’s gave no reason for its withdrawal, other than the usual “at the consignor’s request”, though the depiction of a topless woman in the arms of a lascivious Dutch gentleman is probably not in tune with today’s taste.

And finally . . . Congratulations to Jack Bell, a specialist in west African contemporary art, whose London gallery celebrates its 10th anniversary on Monday. Bell has been at the forefront of African art’s huge market growth and brought artists such as the painter Aboudia (Ivory Coast) and the photographer Leonce Raphael Agbodjelou (Republic of Benin) to international attention. Bell describes the past 10 years as “good and full on” and credits Touria El Glaoui, founder of the 1-54 Contemporary African Art Fair in London in 2013, as key to building real momentum. “Then the museums got behind the market, filling holes in their collections, especially in America,” Bell says.

His next show is of his newest artist, Marc Padeu, who was born in Cameroon in 1990. Padeu’s large-scale paintings centre on a man, painted in blue, who is a long-serving worker at a Haut-Penja banana plantation (The Blue Man of Njombé, February 14-28). Bell’s business is still going strong: all five of Padeu’s paintings, priced at £18,000-£25,000, have sold already.

Follow @FTLifeArts on Twitter to find out about our latest stories first. Listen to our culture podcast, Culture Call, where editors Gris and Lilah dig into the trends shaping life in the 2020s, interview the people breaking new ground and bring you behind the scenes of FT Life & Arts journalism. Subscribe on Apple, Spotify, or wherever you listen.

Comments