Building a sustainable future

If the UK is to deliver net-zero emissions on time, the built environment will need to be radically transformed. The good news is that this could create thousands of jobs.

There is nothing immediately obvious linking the rolling green hills of the Dorset countryside with London’s Square Mile, the densely packed area of historic and high-rise buildings that is home to the UK’s financial centre.

But before long, thousands of solar panels located in the south-western county will provide more than half the electricity supplying the historic buildings of the City’s governing body in a deal that will see green energy powering everything from Smithfield Market to the Barbican arts centre.

The £40m agreement, which is expected to save the City of London Corporation about £3m in electricity, is an example of the sort of steps cities and towns across the country need to take for the UK to achieve its goal of becoming carbon neutral by 2050.

Approximately 40 per cent of the UK’s carbon emissions are attributable to the built environment, according to the UK Green Building Council, a charity with a mission to radically improve the sustainability of the built environment. About half of those emissions stem from energy usage within buildings.

Experts say the built environment represents one of the most important potential levers for achieving net-zero emissions and related social and economic gains over the coming decades.

"This sector has significant potential to decarbonise and unlock wider benefits across the economy," argues Dr Rhian-Mari Thomas, CEO, Green Finance Institute, who points to "energy savings that increase consumer spending power, healthier homes that reduce the burden on our health system, and the creation of new skilled jobs that can help stimulate the UK’s economic recovery".

A retrofit revolution

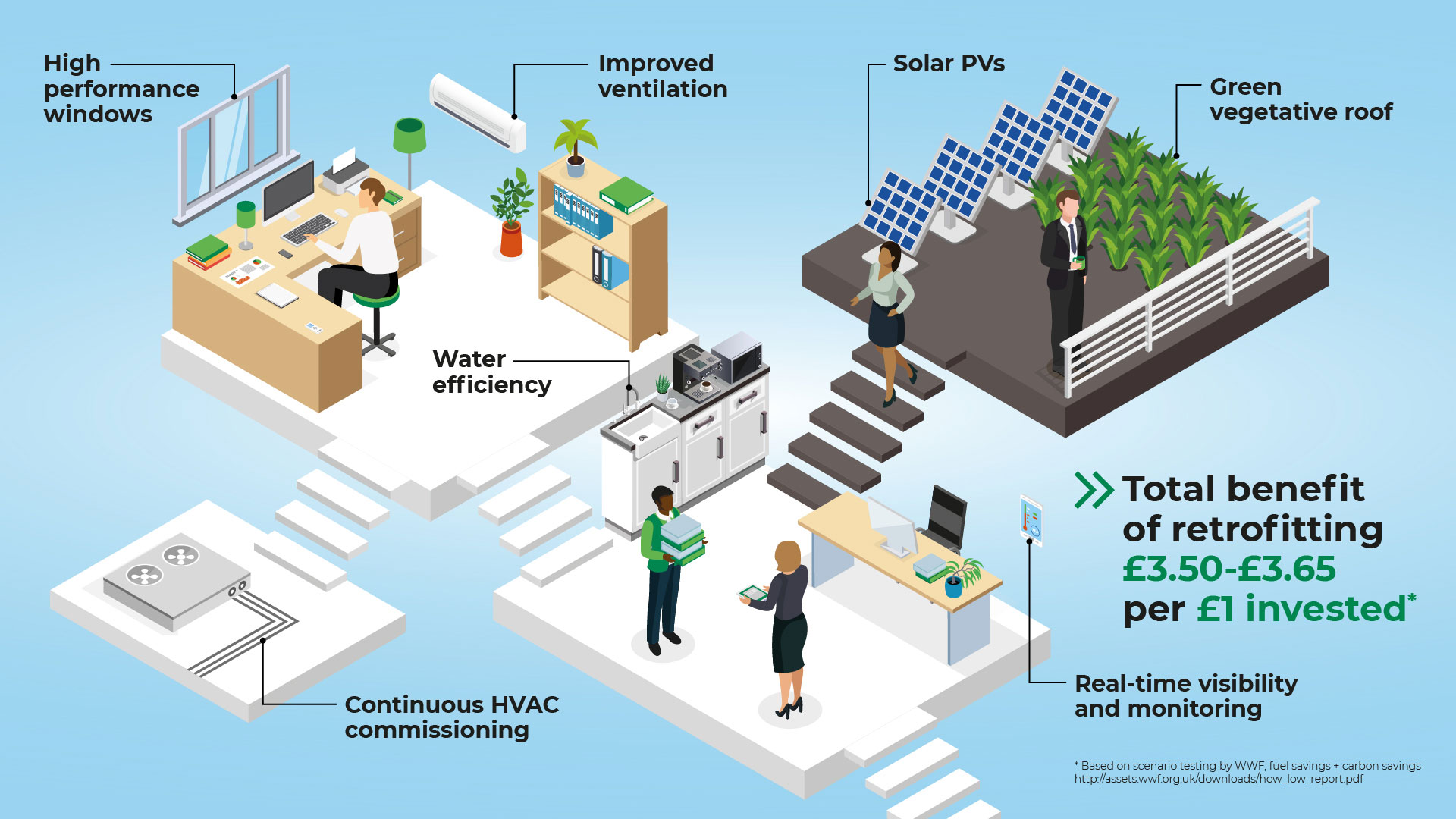

Estimates suggest that as many as 60-80 per cent of the country's 2m commercial buildings and almost all of its 29m residential homes will require retrofitting to meet net-zero targets. For residential buildings alone, that works out at about 1.8 homes being retrofitted every minute between now and 2050.

UK100, a cross-party taskforce of 24 mayors and local government leaders, calculates that more than 455,000 jobs could be created through the construction and retrofitting industry, producing what it calls a “retrofit army” that could push the country towards net-zero while kickstarting the economy in the wake of Covid-19.

Emma Harvey, programme director at the Green Finance Institute, says that innovative financial products will play a pivotal role in Britain’s ability to retrofit its existing housing stock to meet the 2050 goals.

The Green Finance Institute is working with cross-sector organisations to help design lending products that enable homeowners to borrow against the equity in their property in order to invest in energy-efficient improvements. Other projects include schemes in which financial institutions provide long-term capital for retrofit projects and are repaid via additional property taxes collected by local authorities.

“There are some really large barriers to decarbonising the built environment but there are also a host of organisations that are stepping into the space to unlock those barriers,” says Harvey.

One of them is Lloyds Bank. Since 2016, it has provided more than £1bn in funding through its Green Lending Initiative to help clients improve the energy efficiency of their buildings or to develop new ‘green’ buildings.

A host of organisations are stepping into the space to unlock the barriers to decarbonising the built environment

“We are helping clients improve the energy efficiency of over 19m square foot of real estate through the Green Lending Initiative.” said Madeleine McDougall, managing director, Real Estate & Housing at Lloyds Bank Commercial Banking.

More recently, and in association with CFP Green Buildings, it launched the Green Buildings Tool, which can analyse how a range of energy-saving initiatives would improve running costs and reduce emissions, impacting the energy performance certificate (EPC) rating of buildings.

For smaller businesses, the tool can save time and money by helping to identify actions that lead to energy efficiency gains. For bigger commercial businesses, it can process entire real-estate portfolios, providing wider recommendations.

The human factor

Nick Robins, professor in practice – sustainable finance at the London School of Economics’ Grantham Research Institute on Climate Change and the Environment, says that a systemic approach is needed to financing net-zero across the built environment. This means identifying the different mixes of incentives, requirements and support needed to shift different market segments, ranging from commercial property, through social housing on to private rented and owner occupied.

“The human dimension of net-zero cannot be ignored in this process of transformation,” he says. “This means linking decarbonisation with the social value framework and place-making on the commercial side and focusing on the behavioural dimensions and overcoming inequality in residential."

Whether you are motivated by cost or by carbon, there is a big argument for improving energy efficiency

Emma Harvey of the Green Finance Institute insists the government has an important role to play in creating the right incentives through a long-term strategy. “Policies and initiatives that can build certainty in the market are vital to build the necessary skills and supply chain to deliver projects,” she argues.

Julie Hirigoyen, chief executive of the UK Green Building Council, says that the resulting benefits would not only create jobs and help Britain on its journey to net-zero but they would also produce an estimated £4.5bn saving on energy bills between now and 2030. “Whether you are motivated by cost or by carbon, there is a big argument for improving energy efficiency,” she says.