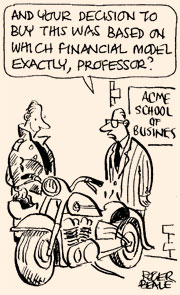

Financial tools must be handled with care

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

A man ploughs his Lamborghini into two parked cars. Who is to blame? It’s probably not the car. Likewise, however much we thump our computer keyboards when a programme crashes, we know that the bug is the result of human error – either by us in using the software or by the person who wrote it. Computers only do what we tell them to do. The same applies to financial models.

However, financial modelling has drawn fire for contributing to or, worse still, being at the heart of the recent financial pile-up. Such a view is unfair, not to mention unhelpful. The world still needs financial models: they are useful analytical tools for understanding complex business situations. It is up to managers to learn how to steer them properly and thus avoid crashes.

The challenge facing business schools today is to guide aspiring and seasoned executives through the minefield of financial models so that the mistakes of the current generation of leaders will not be repeated. Sadly, business schools have failed to provide a real understanding of the intricacy of financial models.

Business schools, often faced with pressure from participants who want quick and easy results, have caved in to presenting models as tools that “you can use tomorrow when you get back to the office”. Yet a course using financial models must go deeper. It must undertake a painful intellectual tour that fully explains the limited range of applications. We can’t overlook the message that not all models can be used in all situations. Financial models are tools that are created to solve specific problems and need to be used only to address particular issues.

In equipping tomorrow’s talent to deal with financial models, business schools should focus on the following: First, helping to fight the fog. Financial models need not be obscure. There are a number of different alternatives, some of which are neither highly mathematical nor opaque. If you need to price an option for example, the Black-Merton-Scholes (BMS) model delivers the “perfect” answer (perfect under a set of very restrictive assumptions). However, when most use the BMS model they focus only on its input and output, without a deeper understanding of how the model operates or can be applied. If this is the case, you may consider using the binomial pricing model instead, which looks at the different possible paths a stock price can achieve over the life of the option.

The two models are indeed “equivalent” but I have found that students and managers alike often believe that the binomial pricing model gives them more “control” over the inputs and the process.

Secondly, make sure that everyone is doing the necessary homework. The recent crisis was fuelled by leverage, risk-taking and perverse incentives. Laziness and complacency also played their part. Everybody stopped doing their homework while hoping that someone else would do it for them. Ask the tough questions. Do not be fooled by elegance: Why are we using this particular model? Is this the best alternative we have? Have the assumptions been met? And if assumptions have not been met, does this make a material difference? Any answers may help you better under- stand whether the financial model you use has been customised to tackle your problem or is a standard, ready-to-use solution (that has little to do with the problem that you face). In the latter case, start the process again: Do not be fooled again!

Finally, we should encourage tomorrow’s leaders to hone their judgment: their intuition and knowledge are their only competitive advantage and the only real assets left when things go wrong.

Financial models are just decision-making tools and are a much-needed part of a manager’s toolkit.

Faced with the uncertainties of the business world, sensible use of financial models can help companies make crucial decisions at the right time.

The writer is professor of finance at IMD and teaches on the Building on Talent, Strategic Finance and Orchestrating Winning Performance programmes

Comments