Six charts: How asset managers have closed pay gap with bankers

Simply sign up to the UK banks myFT Digest -- delivered directly to your inbox.

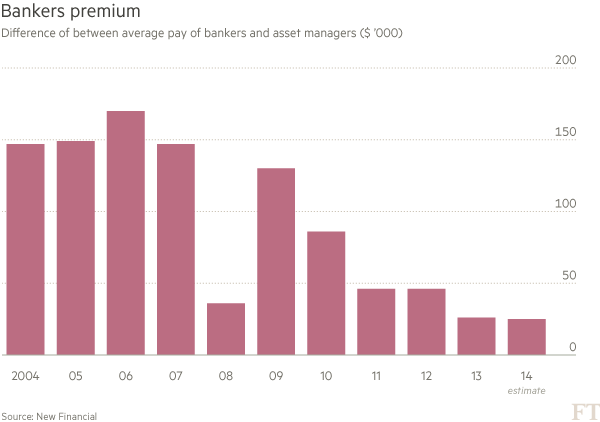

In financial markets, investment bankers traditionally have held the bragging rights on pay over those working in asset management.

But that is changing, according to research from think-tank New Financial that illustrates a shifting balance in global capital markets following the financial crisis.

Asset managers in the so-called “buyside” are set to be paid more than investment bankers in the “sellside” by 2016 if current trends continue, according to the research. Here are six charts showing the trend:

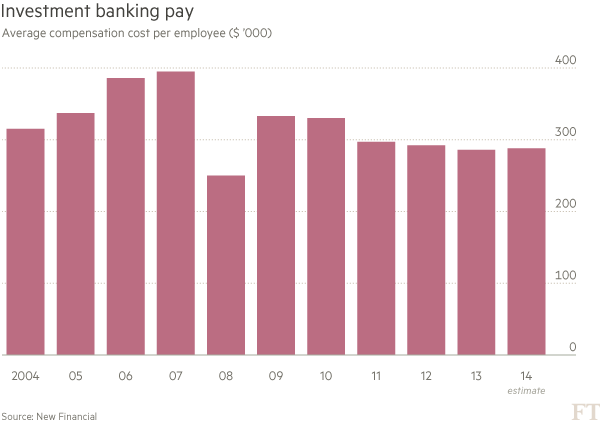

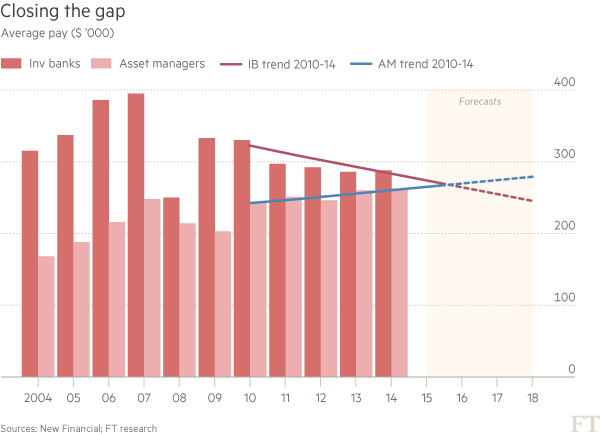

Compensation cost per employee — an imperfect but constant proxy for pay — at global investment banks ticked up slightly last year after four consecutive years of decline.

Average pay at the 12 investment banks sampled was $288,000 up from $286,000 in 2013. Average pay, however, remained 27 per cent below the pre-crisis peak of $395,000 seen in 2007.

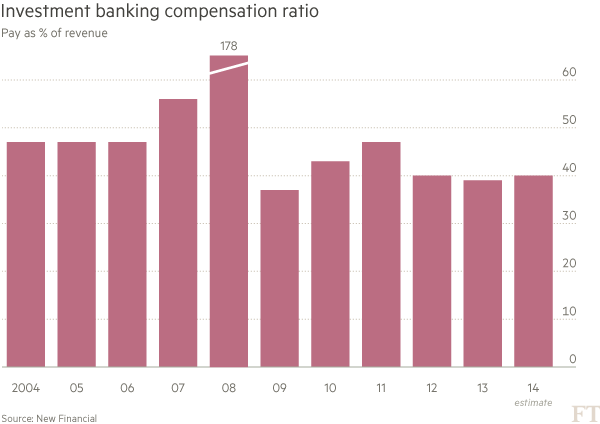

Bankers also received a greater share of their efforts in 2014; pay as a proportion of revenue increased to 41 per cent from 39 per cent in 2013. This “compensation ratio” also remains well below pre-crisis levels; 49 per cent on average in the years leading up to 2008.

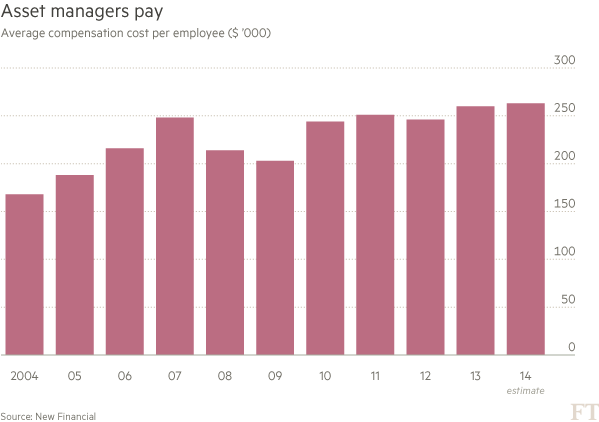

In contrast with investment bankers, average pay at asset management firms has been steadily rising since 2009 and hit a 10-year high of $263,000 last year, up from $260,000 in 2013.

Investment bankers have traditionally enjoyed a large pay premium over their colleagues in asset management; about $150,000 in pre-crisis years. Since the crisis this gap has been steadily eroded. Last year the gap was only $25,000 down from $26,000 in 2013.

If current trends in pay continue, asset managers will be taking home as much as investment bankers as early as next year and FT estimates point to a 16 per cent premium in asset manager pay by 2018.

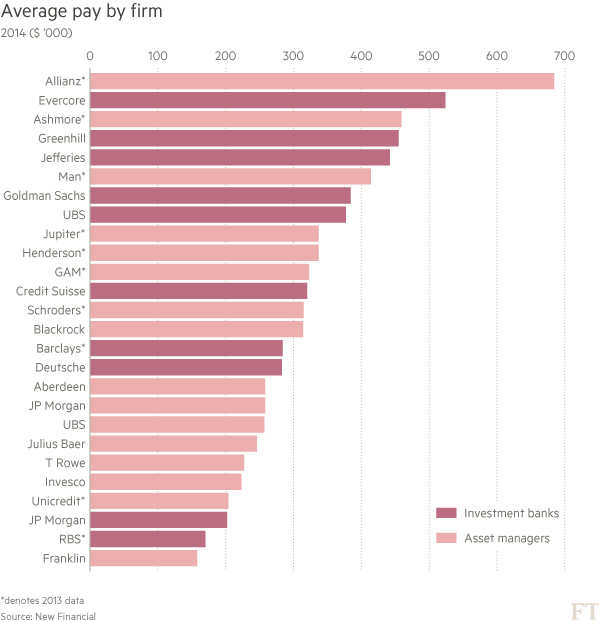

Investment bankers at UBS took home more than their asset management colleagues last year — $377,000 on average compared with $257,000 respectively. At JPMorgan, however, the opposite is true; asset managers received $258,000 compared with $202,000 for investment bankers.

Comments