The footsy index: how sneakers became very big business

Simply sign up to the Life & Arts myFT Digest -- delivered directly to your inbox.

In a brick-lined first-floor converted apartment on Lenox Avenue in Harlem, the father-and-son duo of Troy and Chase Reed spend their days helping young New Yorkers overcome cash flow problems. While they’re not exactly a charitable concern, the Reeds’ pawnshop has become a pocket-lining oasis for the young and hard-up whose assets come laced-up and box-fresh — sneakers.

For the Reeds, Sneaker Pawn USA sprouted from a common patriarchal dilemma: the constant doling out of cash to a teenage son. The solution was to appropriate the newest pair of Chase’s sneakers and return them only when the loan had been paid off. “Then my son started showing me these pictures of people’s collections on Instagram and I was in amazement,” says Troy.

“I asked my son ‘Do you think these kids own all these sneakers?’ and he said ‘Yeah dad, these are people’s sneaker closets.’ So I thought if my son doesn’t have money, imagine how many other kids don’t have money but do have sneakers. I knew Sneaker Pawn was going to work the first day we opened, because somebody bought 60 pairs of sneakers. I knew right then and there this idea was a no-brainer.”

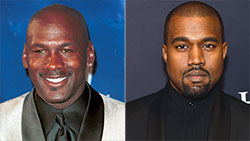

The sneaker market as we know it today was born in the early 1980s when sportswear and hip-hop culture were conjoined with two momentous events: hip-hop group Run DMC’s release of “My Adidas” and their subsequent branding by the firm from Herzogenaurach; and the arrival of basketball legend Michael Jordan’s signature Nike Air Jordan 1. Together they catalysed a street style that young people across the world could reference.

“We don’t have the total international sneaker market figures today but the NPD consumer panel data shows the US retail sneaker market is alone worth approximately $28bn,” says Matt Powell, a sports industry analyst at the market researcher group, and author of the Sneakernomics blog at Forbes. According to figures from sports industry news site SportsOneSource, the international market has grown by more than 40% since 2004 and is estimated to be worth in the region of $55bn a year, or about the GDP of Kenya.

“Sneakers are a part of the fabric of society,” says Kish Kash, a London-based hip-hop DJ and trainer collector. “I don’t know how many pairs I own — I stopped counting at about 2,000. I’m sure there are people out there with more, but it’s not how many you’ve got, it’s what you’ve got.”

Or rather, what others want. To the uninitiated, the sneaker world can seem as closed and elitist as the fashion industry, followed with unabated fervour by the few (for “fashionistas” read “sneakerheads”); the rest of us are happy to consume new styles and trends at a more negotiable pace. Where the two markets diverge however, is in exclusivity. Yes, high-end fashion is exclusive . . . but you’ll never see round-the-block crowds camping outside of a Gucci or Prada store waiting to get their hands on the new season’s designs.

“The main sports brands have long since known that with credible collaborations and limited releases, they can generate unrequited demand to drive up hype and support future sales,” explains Powell. When it comes to sneakers, hype drives the halo effect — it’s self-sustaining marketing at its best.

For sneakerheads, missing out on a limited edition collaboration means looking for the same “kicks” on a resale market where the mark-ups are astounding. Want a pair of 2014 Nike Air Yeezy 2 “Red Octobers” as designed by rapper Kanye West? That’ll be $5,000. Or perhaps a pair of 2005 Nike Air Jordan IV Retro Eminem Slim Shadys? They are on sale on eBay for $26,000.

“In the last couple of years the sneaker world has gone pretty nuts,” says Fraser Cooke, who heads up the Global Energy marketing division at Nike, overseeing the brand’s many high-profile partnerships, including an overhaul of the Nike Air Force with the Givenchy designer Riccardo Tisci, and most recently a collaboration with the Japanese brand Sacai. “The original architecture of this culture, pre-internet, was more stylistically driven than it is today. For us it was all about style first — rarity and exclusivity wasn’t really interesting back then.”

The resale market is now estimated to be valued at $1bn. “On the surface, the secondary market may look like a stock market but it’s more similar to the illegal drug trade,” says Josh Luber, the 37-year-old IBM strategy consultant, collector and self-professed data nerd behind campless.com, a site that analyses over 19 million eBay auctions, collecting sneaker data on price, volatility, resell premium, market availability and deadstock percentage. Deadstock describes an immaculate unworn shoe with the laces still in the factory configuration and the box and internal tissue paper untainted. One collector told me that dedicated collectors will often buy two pairs of the same release: “One to rock and one to stock.”

In a survey Luber conducted into the profiles of collectors, he found that around a third had never sold a pair and another third would only occasionally sell a pair to fund a new purchase; a mere 5% are in it solely to make a profit — all of which suggests that Moody’s won’t be lifting sneakers to investment grade any time soon. Nevertheless, as today’s sneaker-collecting teenager becomes tomorrow’s sneaker-collecting twenty-something with his own disposable income, resale prices will continue to increase, especially if Nike and others continue with the same limited-release strategy.

“The fundamental way to win in the secondary market is to be able to buy the sneakers, especially limited edition ones, at the retail price, which is a monumental challenge for a lot of reasons,” says Luber. “You either need to be prepared to camp out at stores, or you need smart computer programmes that will buy online before anyone else.” For example, Nike’s Air Yeezy 2 “Red October” sneakers designed by Kanye West sold out in 10 minutes online. As for camp-outs, retailers try to limit them by using a raffle ticket system instead. While that doesn’t reward those with patience, it does protect them. A number of Nike releases have turned violent in recent years, with riots, fights and attempted looting. When Nike released its Lebron X “Denim” in 2013, a customer waiting in line outside Atlanta’s Wish boutique shot dead another man attempting to rob lucky customers as they left the store.

Husband and wife team Nathan and Elisha Massiah, otherwise known as Fresh Laces (freshlaces.co.uk), offer to do the hard yards for you. Just recently they installed a boutique in Harvey Nichols in London where they sell extremely rare and sought-after sneakers they’ve sourced from around the world. The success of their venture is indicative of the current crossover between street culture and high-end fashion.

“Some of the designers who have started to take over these big luxury fashion houses grew up with street style,” says Cooke. “I worked on the Riccardo Tisci project, for example, and Riccardo loves that shoe, he’s been wearing it for the last 10 years. He’s had a long and genuine affiliation with Nike. It’s that kind of credibility which makes a collaboration really great.”

While scarcity accounts for much of the inflated prices in the secondary market, the credibility that Cooke speaks of is everything, especially given the high frequency of collaborations. But as Luber points out, credibility is anything with a Nike swoosh on it: “96% of the eBay sneakerhead market last year was Nike and Jordans. In 2013, $62.7 million was spent on eBay just on Jordans 3 through 14 alone. Sneakerheads joke that it doesn’t matter what the shoe is — as long as it’s limited and Nike, they will buy it.”

That dynamic might soon change. Kanye West — the only name in the sneaker market with the customer appeal to challenge Michael Jordan’s dominance — has left Nike for nearest rival Adidas for a rumoured $10m deal plus royalties. The music star severed his ties with Nike after seven years and two shoes, in late 2013, stating that his contract fell through because they wouldn’t offer him sufficient royalties.

West’s Adidas Yeezy Boost sneakers (he even took the Yeezy name with him) were available on the secondary market in February at an average of $1,573, a 450% mark-up on the retail price (and that despite a further limited release across Europe on Thursday this week, exclusive to six European Footlocker stores and online). Perhaps more revealing about Adidas’s strategy is its recent unveiling of Confirmed, an app that will allow users to reserve limited edition items on a first-click-first-serve basis. Having recently suffered a slump in profits, the Yeezy effect can’t come soon enough.

The dynamics of how limited sneakers are released varies but most occur on a Saturday morning, with many drops requiring in-store registration the day before. “Outside of its biggest stores such as Nike Town on Oxford Street, Nike designate certain sneaker boutiques with various levels of status,” says Massiah. There are only five Tier Zero boutiques [the highest], in the UK, and they are given limited numbers of the biggest releases. However, in February alone this year there were 188 sneaker releases documented on solecollector.com, begging the question, isn’t there a risk that a market dominated by one brand is being primed for a pop?

“We’re at a pretty interesting inflection point in the secondary market right now,” says Luber. “In 2012-13, month-on-month growth in dollar terms was over 60%, it was just crazy. But last January and February were the first two negative months of growth in the three years we’ve been tracking the resale market.”

If the sheer frequency of new releases becomes an Achilles heel, then China could be the corrective insole. An estimated 300 million people in China play basketball but Mike Powell puts the sneaker business there at only 20-25% of the size of the US business. With a population four times that of the US, an ever-expanding middle class, and a growing number of Chinese NBA stars, Powell thinks it is reasonable to expect that China’s sales will eventually overtake the US and who knows what the resale market will look like then.

“I know one thing for sure,” says Massiah. “There will always be sneakerheads looking to feed their habit.”

Photographs: Corbis; Jonathan Elderfield; 2015 Paras Griffin; Globe Photos; 1989 Amblin Entertainment

Comments