Flash crash: Lone trader seen as ‘a strange character but genius’

Simply sign up to the US & Canadian companies myFT Digest -- delivered directly to your inbox.

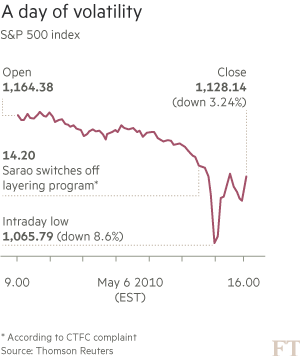

On May 6 2010, when the US stock markets plunged 600 points and rebounded within 20 panic-stricken minutes — an event that became known as the “flash crash” — an independent trader from west London received a warning about his behaviour from the US’s largest futures exchange.

It was the third warning the Chicago Mercantile Exchange had sent to Navinder Singh Sarao, the 36-year-old British-born trader, and his broker, for placing and then quickly cancelling orders — a practice known as “spoofing”. Orders were “expected to be entered in good faith for the purpose of executing bona fide transactions”, the CME told him.

If this worried him at all, however, Mr Sarao could at least console himself with the fact that, by the time the market closed, he had made $879,018. And two weeks later, he would brag to his broker that he had told the CME to “kiss my ass”.

This week Mr Sarao has found himself inside a London courtroom facing criminal and civil charges from the US Department of Justice and Commodity Futures Trading Commission for allegedly contributing to the panic that day and embarking on a pattern of behaviour that is said to have netted him nearly $40m in four years.

On Wednesday Mr Sarao, dressed in tracksuit trousers and a canary yellow sweatshirt, was given conditional bail of £5.05m as he prepared to fight efforts by US authorities to extradite him to Illinois to be tried for wire fraud, commodities fraud, commodities manipulation and spoofing. He faces as much as 25 years in prison if found guilty.

Mr Sarao was hardly a masters of the universe type, nor did he fit the mould of the “flash” traders who use ultra-fast internet connections and sophisticated software to gain a millisecond advantage. Instead, he traded on a customised version of an off-the-shelf software program from his modest home in Hounslow, a drab London suburb. So far he is the only person accused in connection with the flash crash.

His arrest has revived criticism of the market oversight by the CME and other regulators — and prompted some to ask whether Mr Sarao has been made a scapegoat while the role of larger players has gone unpunished. And despite untold hours spent by US regulators investigating one of the most mysterious episodes in market history, authorities only brought this case after a whistleblower provided hundreds of hours of analysis of the trades, a lawyer for the whistleblower said.

To critics, the idea that a lone trader could help wreak so much havoc demonstrates that the fragmented US system of regulatory oversight is unsuited to a financial market that is so closely connected by computerised trading.

“The fact that it took five years to catch [arrest] this guy is a symptom of a broken enforcement system,” says James Angel, a professor at Georgetown University.

Mr Sarao came of age just as the markets shifted to electronic trading. With the CME’s launch in 1997 of the “e-mini S&P”, a compact futures contract based on the S&P 500, investors had a smooth way of betting on the direction of the cash equity market. They could also use the contract to insulate their portfolios from losses.

That attracted Mr Sarao, a British trader whose family lived under the main flight path into Heathrow airport. He got his start on the trainee programme of a small UK broker in 2003 and quickly stood out. “He was a bit of a strange character but he was a natural, a genius,” says a person who watched him trade. “He could read a screen like you and I could read a newspaper.” Mr Sarao stayed cool, wearing heavy-duty headphones to block out the noise of a trading floor. “He also used to dress shabbily as he didn’t care,” the person said.

He developed a reputation for making big trades, according to two people familiar with his positions. “One day he traded 5,000 lots [equivalent to a notional value of $250,000] while he was talking to me,” one said.

Mr Sarao described himself as an insomniac who slept from 4am until noon so he could trade on US time, emails in the court filings say.

By 2008 he had started his own firm and bought a seat on the CME, allowing him to trade on Chicago’s markets. Almost immediately the CME noticed his behaviour; by the following March the it had contacted MF Global, his brokerage, to alert them. The company passed the message to Mr Sarao and told him that he may have been breaking the rules.

The problem: Mr Sarao pumped large amounts of orders into the e-mini market, then quickly cancelled them. Tracking his trades between September 2008 and October 2009, the CME noted that the tactic “appeared to have a significant impact on the indicative opening price” of the market.

“When prices fell as a result of this activity, Sarao allegedly sold futures contracts only to buy them back at a lower price,” according to the DoJ. “Conversely, when the market moved back upward as the market activity ceased, Sarao allegedly bought contracts only to sell them at a higher price.”

The regulators allege Mr Sarao was rapidly placing and cancelling orders on May 6, 2010. In less than two hours he placed six e-mini orders, which were replaced or modified 19,000 times before cancelling them without completing a single trade. In that same period he accounted for between 20 and 29 per cent of the entire e-mini sellside order book on CME, regulators allege.

He also executed real trades, boosting his returns. By 2009, Mr Sarao allegedly began to move money offshore to avoid paying taxes on his profits, according to court filings. In 2010 he created a company, Nav Sarao Milking Markets, incorporating it in Nevis, a small island in the Caribbean.

In 2011 he created a company called International Guarantee Corp that he based in Anguilla with a bank account in Switzerland. He used IGC to make loans to his trading firm and invest in other companies. A year later, according to court filings, he authorised a transfer from another Swiss bank account to the United Arab Bank in Dubai.

But Mr Sarao’s allegedly manipulative trading continued, and it was not until at least the end of 2013 that US regulators opened their investigations.

The unmasking of Mr Sarao has raised eyebrows among traders and the broader industry. Markets by their nature reflect the choices and actions of numerous people and no single trade or activity can be held responsible for big market swings, observers say.

“It is possible that it [Mr Sarao’s trading] was a factor among many that contributed to what happened on that day,” says Justin Schack, managing director at Rosenblatt Securities. “What is hard to believe is that this guy is the Franz Ferdinand of the flash crash.”

The CME this week reiterated its position that its own investigations, and those of regulators, found that the futures market was not to blame. Regulators say the arrest of Mr Sarao did not mean that their report was wrong or that other players, like large money managers, did not play a role.

The official report on the flash crash, released in September 2010, highlighted the impact of a rapidly executed $4.1bn sale of stock index futures by a single institutional investor, Waddell & Reed, which began at 2:32pm EST. A trade of that size went well beyond what Mr Sarao could have done. According to the complaints, Mr Sarao switched off his layering program at 2.40pm that day, two minutes before the S&P 500 really started to plummet. He kept trading during the crash and for years after.

Andrei Kirilenko, professor at the MIT Sloan School of Management and joint author of the report into the flash crash, says it is hard to see the connection between the algorithm in his customised program and what happened later. “The complaint says that this algorithm is present a bunch of times before and after the flash crash, but is actually not there during the most volatile period of the flash crash.”

While regulators debate the structure of the markets, a new vitality appears to have taken hold among prosecutors. “With this turn of events, we need to acknowledge that it is the FBI and the Department of Justice that are now in charge of how this market will operate,” says Prof Kirilenko. “This changes things.”

Additional reporting by Michael Mackenzie and Nicole Bullock

Comments