Bank stocks poised for best year since global financial crisis

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

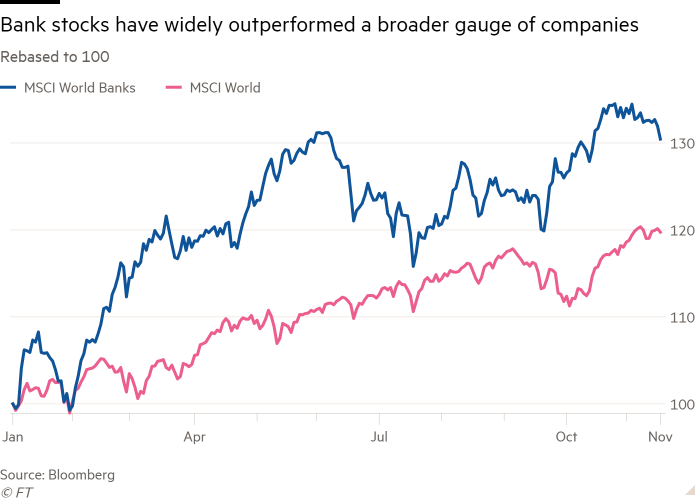

Global bank stocks are on track to record their best year since the wake of the financial crisis, benefiting from expectations of higher borrowing costs as rate-setters battle widespread inflation.

An MSCI benchmark tracking global bank shares — measured in US dollars — has jumped by around 30 per cent so far in 2021, a stronger performance than the roughly 20 per cent rise for the index provider’s all-sector gauge.

Banks have not achieved such gains since 2009, when the same MSCI share index rose more than a third as lenders recovered from the depths of one of the worst crises to hit the financial industry.

US banks in particular have been buoyed by healthy volumes in their trading businesses in recent months, along with “extraordinary” deal advisory activity and the release of reserves set aside to cover bad debts, said Scott Ruesterholz, a fund manager at Insight Investment. “It’s a phenomenal environment to be operating in.”

A KBW index focused on US banks has climbed more than two-fifths this year, positioning it for its best ever annual performance. That improvement is in stark contrast to 2020, when the same index fell around 14 per cent as the pandemic prompted central banks to cut interest rates to record lows, compressing the difference in interest rates banks charge their customers for loans and those they pay on client deposits.

The performance of banks around the world has diverged over a longer timeframe, with the US far surpassing Europe. On a five-year basis, an MSCI index focused on US banks has climbed more than 60 per cent, while its European equivalent (priced in dollars) is down 2 per cent.

Banks tend to track the movements of US 10-year Treasury notes, said Beata Manthey, an equity strategist at Citigroup, who expects yields on the benchmark government bonds to reach 2 per cent around the turn of the year — up from their current level of about 1.6 per cent. Bond yields move inversely to prices.

Mark Haefele, chief investment officer at UBS, noted that along with energy stocks, “financials do well from a recovery but if there is excess inflationary pressure, they can also do well from that”.

The US consumer price index, a key inflation indicator, showed a 6.2 per cent increase in October from the same period a year earlier — marking its fastest ascent since 1990. UK inflation hit 4.1 per cent in the same month, data showed last week.

In turn, traders are now betting that the Bank of England will raise borrowing costs to 0.25 per cent in December, from their current level of 0.1 per cent, after the BoE’s surprise decision to hold rates steady this month.

Subsequently, markets are factoring in “maybe [0.75 per cent] to 1 per cent interest rates” in the UK by the end of next year, said Alex Wright, fund manager at Fidelity. Such a scenario would boost British retail bank NatWest’s profits by 24 per cent, he said, while adding 12 per cent to Lloyds’ earnings and 8 per cent to Barclays’.

A rise of 1 percentage point [at the ECB and the Fed] would similarly send US banks’ earnings up 17 per cent and European earnings up by a quarter, according to Stuart Graham, analyst at Autonomous Research.

Those prospective increases have bolstered analysts’ bullishness. Half of investors surveyed by Bank of America this month said they were overweight European banks, the highest proportion on record, based on data going back to 2003.

Bill Nygren, chief investment officer for US equities at Harris Associates, is optimistic that bank shares will continue to climb, albeit from a low base. “We’ve ridden down a long steep decline and now we’ve had this little rally up a bunny hill,” he said. “But we think ‘normal’ could be quite a bit higher than today.”

Comments