Investors wonder if the 60/40 portfolio has a future

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

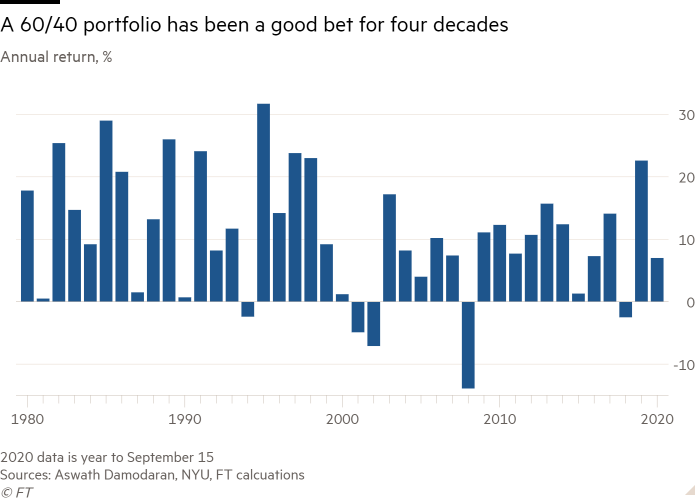

The traditional 60/40 portfolio — the mix of equities and bonds that has been a mainstay of investment strategy for decades — is at risk of becoming obsolete as some investors predict years of underperformance by both its component parts.

With stocks and government bonds at historically high valuations, savers are being forced to seek out alternatives, potentially creating a boon for other asset classes but also pitching long-term investors into uncharted territory.

A “nuclear winter” beckons for the 60/40 portfolio in the 2020s, said Vincent Deluard, global macro strategist at StoneX Group, who predicts inflation-adjusted returns could be just a fraction of the 8.1 per cent enjoyed in the past decade.

“It is hard to see where your equity return comes from,” he said, and “low bond yields will not help offset a poor performance from the share market. It’s just the math.”

Retirement savers around the world have typically employed some version of the 60/40 balanced portfolio, with a majority in equities, whose performance reflects economic growth, and a significant minority in bonds, which act as a stabiliser because of their fixed income, limited volatility and tendency to rise in value during times of market stress. Older savers often shift the balance in favour of bonds.

Developments this year have prompted warnings on the outlook from many of the biggest names in the investing world. Tony James, vice-chairman of Blackstone, last week predicted a “lost decade” for stocks as companies struggle to recover from coronavirus. Stanley Druckenmiller, a veteran of the hedge fund industry, said markets were suffering from a “raging mania” after interventions by the Federal Reserve caused the US stock market to add back all its coronavirus losses and more.

A mix of equities and bonds split 60/40 has generated a compound annual growth rate of 10.2 per cent in the US since 1980. It is up 7 per cent this year: the S&P 500 has returned 4.2 per cent, including the reinvestment of dividends, the Bloomberg Barclays index of US Treasuries has returned as much as 11.3 per cent, as official interest rates have been taken to zero. Bond prices rise as yields fall.

Despite a pullback in recent weeks, investors warn equity valuations are historically high, while government bonds are historically risky. The forward price-to-earnings ratio for the S&P 500 stands at 21.7 times, according to FactSet, versus an average of 15.4 times over the past 20 years, with tech valuations among those looking particularly stretched.

And with yields so low, even small changes could lead to big price swings for Treasuries and potentially big losses if inflation rises and interest rates have to follow.

Analysts at Bernstein wrote that valuations imply returns of about 5 per cent per annum on the S&P 500 for the next decade and that “today's unprecedented low level of yields means that future returns are likely to be low and interest-rate risk is higher than ever before”.

Investment strategists have suggested alternative sources of stable income to replace Treasuries, although all have additional risks that US government debt does not. The list includes private equity, real estate, infrastructure, inflation-linked bonds and dividend-paying equities.

Abdur Nimeri, head of institutional multi-asset programs at Northern Trust Asset Management, said: “We are seeing a repositioning of portfolios toward real estate and infrastructure” which could “help dampen volatility” for investors.

Others have suggested less radical tweaks to the 60/40 portfolio, in which investors switch their fixed-income exposure from sovereign debt to high-quality corporate bonds, but with companies’ credit quality on the line in times of crisis or recession, these can follow equities and not Treasury bonds during market swoons, making for a less well-balanced portfolio.

David Kelly, chief global strategist at JPMorgan Funds, said “the standard 60/40 portfolio is not very well suited for today’s financial market environment”. Investors require a “multicoloured pie, that shifts away from [US] bonds and large-cap stocks”, he said, finding balance instead by adding more asset classes, including foreign equities, value stocks and emerging market assets.

Mr Deluard of StoneX said investors need to rethink their portfolios, and as soon as possible. “Long-term asset allocators will need to find a replacement strategy if they are to meet their target returns,” he said.

Comments