US corporate debt is high but not yet dangerous

Simply sign up to the Global Economy myFT Digest -- delivered directly to your inbox.

The severe squall in equity markets late last year — caused by miscommunication about monetary policy by the Federal Reserve, disruptive US trade policy and deleveraging in China — has been brought under control. Simultaneous policy adjustments in all areas have worked, as they did in similar circumstances in 2016. But further gains in equity markets from here will require deeper economic fundamentals to perform well.

Among these fundamentals, the financial health and profitability of the US corporate sector is, as usual, paramount. As the Fed itself has recently emphasised, corporate debt in the US has risen to very high levels during the expansion, especially in highly leveraged companies. Furthermore, profit margins appear to have peaked, and are under downward pressure as wage inflation rises. So how healthy is the American corporate sector?

First, overall debt levels are certainly very high, but mostly for good reasons.

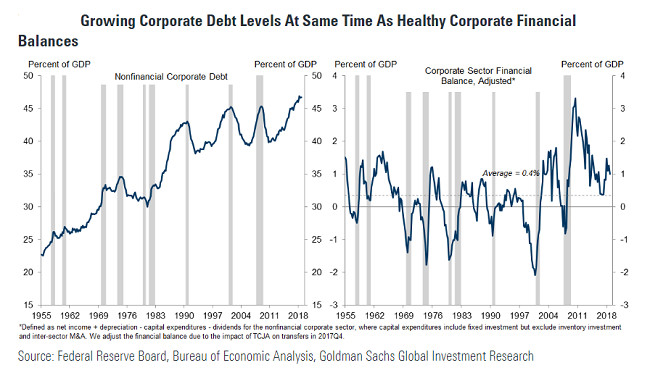

The ratio of outstanding non-financial corporate debt to GDP has risen from 40 per cent in 2011 to 47 per cent today, an all-time high. Superficially, this certainly looks worrying, especially since similar levels of debt have preceded the last three US recessions in 1990, 1999 and 2007. High levels of leverage are often seen as a warning sign that companies are vulnerable to downside shocks in economic activity, or upside shocks in interest rates.

However, there are several reasons for believing that today’s very high debt levels are not a reason for great concern. Interest rates remain exceptionally low in nominal and real terms, so the burden of interest payments or debt service is well within historical limits.

Furthermore, corporate savings have remained substantially above fixed investment throughout the recent expansion, so the sector has been running an unusually large financial surplus. Capex has been self-financed, providing a cushion in case of an adverse change in profits or interest rates.

According to recent work by Brian Chen at Goldman Sachs (see graph below), the financial balance provides a better early warning indicator of financial crisis than outstanding debt. At present, that indicator is extremely benign.

Finally, it is important to note that increases in corporate debt have been deliberately used to repurchase outstanding equities, and this has supported the equity market. As a result, the ratio of corporate debt to net worth has remained very healthy. The increase in debt has resulted from a planned restructuring of the balance sheet, not from a need to finance uncontrolled cash outflows.

Second, profit margins have started to decline, but are still at high historical levels.

Although balance sheets remain healthy, financial problems could arise fairly quickly if profits growth turns sharply negative. This can happen if revenue growth slows, or if profit margins begin to decline. Revenue growth is indeed slowing, but only very gradually, in line with the slight slowdown in nominal GDP. Therefore the main threat to profits would be a large decline in margins, from their present elevated levels.

According to economists at JPMorgan, global profit margins peaked in mid 2018 and are now starting to decline. In the US, margins remain close to all-time highs, but are beginning to drop as wage inflation outstrips the rate of increase in selling prices. In macroeconomic language, the flattening of the Phillips Curve has applied to price inflation but not so much to wage inflation. This means that falling unemployment has lifted wage inflation to around 3.4 per cent, but price inflation has continued to hover around 2 per cent.

As a result, US equity profit margins are set to shrink by about 0.5 percentage points per annum, from their current level of 11.3 per cent. This shrinkage in margins will offset almost all of the benefits from rising revenues, leaving profits growing close to zero, compared to annual rates of 10-20 per cent in recent years. This will not cause a liquidity crisis but the golden phase of the cycle for equities is over.

Third, the distribution of corporate debt is very uneven, and there are legitimate concerns about the leveraged loan market.

Within the corporate sector, the leveraged loan market, which represents about one-tenth of total corporate debt in the advanced economies, is a clear source of elevated risk. Leveraged loans are rising very rapidly, a worrying signal. Furthermore, the covenants on these loans have become extremely lax, and the growth in collateralised loan obligations bears some resemblance to equivalent mortgage debt obligations prior to 2008.

The FT has warned strongly about these risks. It is clear that regulators should be taking pre-emptive action, in order to reverse the excessive rise in leveraged debt, especially from shadow banks operating globally in this space.

Verdict

Overall, US corporate debt ratios are high, but no higher than usual in the late stage of an economic cycle. Debt/net worth and debt servicing ratios are comfortable and the financial balance is unusually strong for so late in the cycle.

Margins are coming under pressure from rising wages, relative to productivity and selling prices. But this downward pressure is gradual, and the absolute level of margins remains historically high.

Within the corporate sector, the leveraged loan market is clearly a pocket of elevated risk, but is under intense scrutiny from regulators. The scale and intensity of these risks seems fairly well contained, for now.

The US corporate sector is no longer a strong plus for equities, but is unlikely to be the major source of a recessionary or financial shock in the near future, and is reasonably well placed to handle any such contractionary shock that emerges from elsewhere.

Comments