Goldman Sachs crashes to bottom of the class as bets turn sour

Simply sign up to the US & Canadian companies myFT Digest -- delivered directly to your inbox.

Was Goldman Sachs — of all banks — wrongfooted by the Trump trade?

Since the election of Donald Trump in November, the Wall Street bank has seen several senior executives decamp to Washington: none of them more influential than Gary Cohn, the bank’s former president now serving as Mr Trump’s top economic adviser.

Despite that apparent edge, the bank was the only one of the US’s top six banks to report disappointing earnings for the first quarter. While rivals were boosted by brighter performances from bond-trading units, Goldman’s revenues from debt trading were basically flat.

Analysts and traders say the bank may well have made a big bet that went wrong during the first quarter: the assumption that Mr Trump’s talk of boosting growth would push up interest rates, and thus push down the price of trillions of dollars of corporate bonds.

That was true enough immediately after Mr Trump won the contest, as yields on double A-rated US corporate bonds rose sharply as prices fell, all the way from three months’ maturity to 30 years.

But between the beginning of January and the end of March prices rose for bonds of between five and ten years to maturity, pushing down yields, as investors began to question their assumptions on the pace and scale of interest-rate increases from the Federal Reserve.

Goldman could have miscalculated the way it managed its inventories of bonds held for trading. It could have been short corporate credit, when the smart bet was to be long.

“Marty said they didn’t ‘navigate’ well,” said one senior figure on Wall Street, alluding to comments during Goldman’s analyst call by Marty Chavez, who was promoted to chief financial officer in a reshuffle prompted by Mr Cohn’s exit.

“That’s code for risk management was bad.”

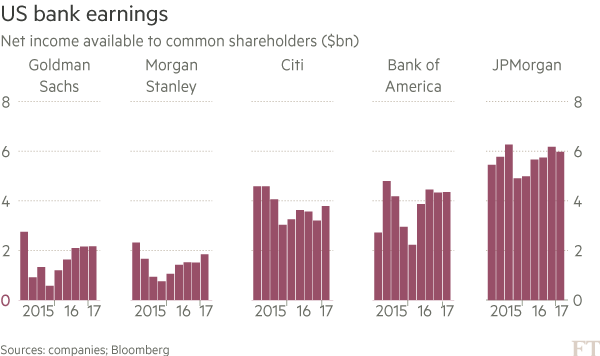

Overall, the big US banks got some of their swagger back during the first quarter. Five of the big six, including Wells Fargo, reported results that were better than analysts’ expectations. Year-on-year gains in bond-trading revenue ranged from 17 per cent at JPMorgan to 96 per cent at Morgan Stanley, Goldman’s closest rival, which smashed its informal $1bn-a-quarter revenue target for the fourth quarter in a row.

That made Goldman’s big miss, undershooting analysts’ estimates for both revenues and net income, all the more remarkable. The bank’s bond-trading revenues came to $1.7bn during the quarter, essentially unchanged from a tough period a year earlier. Analysts at Keefe, Bruyette & Woods had been expecting a 30 per cent rise.

“Hard to put lipstick on these results,” wrote Brennan Hawken, analyst at UBS, in a note to clients.

“Maybe more than the numbers, the damage to the aura of invincibility of the House of Goldman may be the real story,” said Christopher Whalen, an independent analyst.

Few analysts said they were satisfied with the bank’s official explanation. On the earnings call, Mr Chavez essentially blamed a lack of volatility, noting that markets for foreign-exchange and commodities — two of Goldman’s strengths — were unusually calm during the period.

That makes sense, said one trader. He noted that markets were grinding steadily higher during the quarter, rather than moving in ways which would have sparked the interest of shorter-term investors. Goldman has long had a heavy exposure to hedge funds, asset managers, banks and brokerages — groups that are inclined to shut up shop in sideways markets.

By contrast, universal banks such as JPMorgan Chase, Citigroup and Deutsche Bank deal with huge multinationals that need steady flows of interest-rate swaps and currency hedges, whatever markets are doing.

“More volatility would have helped everyone, but certainly Goldman much more,” the trader said.

But one Wall Street analyst, speaking on condition of anonymity, argued that Goldman was trying to have it both ways. It makes no sense, he said, for Mr Chavez to try to blame the bank’s business mix but then to say that “ultimately, we didn’t navigate the market well”.

The analyst noted that Mr Chavez also denied that the bank had a problem with its positioning, saying there was “nothing material in inventory in the context of the firm”.

“Goldman has a history of saying exactly what they want to say and no more, so I think [the new CFO] carried on the tradition quite well,” the analyst said.

Goldman declined to comment beyond what Mr Chavez said on Tuesday.

The bank has been trying for a while to cut its dependence on trading. Over the past few years it has been emphasising business lines that tend to produce stickier, annuity-like revenues, such as investment management and wealth.

It is also pushing into lending, seeking to turn round two back-to-back years of single-digit returns on equity, well short of its usual standards.

But this week’s black mark may linger.

“Something’s clearly wrong at Goldman, and they didn’t articulate clearly what it was,” said Dick Bove, a veteran banks analyst at Rafferty Capital Markets.

After the “shock” earnings miss he slashed his price target for Goldman’s stock from $288 to $221. The shares closed on Wednesday at just over $214, down less than 1 per cent on the day.

On Tuesday, the stock lost 4.7 per cent, the biggest daily fall since the Brexit vote in June last year.

“I think maybe Gary Cohn was the brains behind Goldman,” said Mr Bove. “Maybe his leaving had a bigger impact than people think.”

Additional reporting by Christian Pfrang

This article has been amended since original publication to correct the banks’ low-end range of bond-trading revenue, Goldman notwithstanding.

——————

More on US bank earning season

Morgan Stanley bursts forward in banking pack

BofA profits rise as post-crisis rebound continues

Lex: Goldman Sachs, missing you already

Citi profits up 17% on trading rebound

Wells Fargo profit slips as sales scandal weighs on results

JPMorgan tops forecasts on record investment bank revenues

Comments