UK bank shares face longer-term struggle

Investors in UK banks have been in the hot seat all year, and it is not simply a case of possible Brexit blues.

The UK’s banking sector is seen as a proxy for the country’s economic growth, and share prices have been particularly volatile over concern that an exit from the EU could spark a recession, with a housing market slump hitting lenders’ balance sheets.

Filippo Alloatti, an analyst at Hermes, says that while investors have focused on the historic referendum, the vote has affected “sentiments rather than fundamentals”. The referendum may be an exceptionable event, but the latest gyrations in banking stocks and bonds are, for investors, achingly familiar.

The dramatic collapse in bank prices earlier this year, triggered by the gnawing threat of low and negative interest rates, along with complicated new regulations, remains a more powerful market indication of the threats facing the sector.

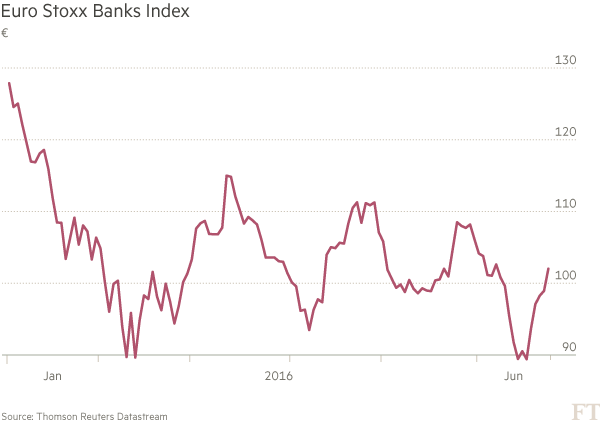

Still, share prices of the country’s major lenders, including Barclays, Royal Bank of Scotland and Lloyds, have risen sharply after referendum polls narrowed late last week. Double digit gains for large banks over the past five days have eclipsed the FTSE 100’s rise of over 6 per cent. The rebound in banks has echoed more widely: the Euro Stoxx banks index is up almost 15 per cent in the past five days.

For investors, given the global threat of low interest rates and weakened profitability, how much of a difference would Brexit actually make?

Some analysts have taken a particularly bearish line on a leave vote. Analysts at Bernstein, for example, last week highlighted the risk of a drop in sterling, as well as a sharp fall in house prices and a rise in unemployment. The research house identified Lloyds as particularly at risk, given its high UK exposure.

Investment banks have publicly and privately warned they will move jobs to the continent in the event of a leave vote. “For the banks, it’s safe to say you’d think the operational costs are going up because of passporting from UK into Europe or Europe into the UK,” says Mr Alloatti. “They add to a hard landing”.

High street banks in the UK also stockpiled cash ahead of the vote, at the behest of the Bank of England, which has cited referendum uncertainty as the biggest risk to the UK’s short-term financial stability.

While new risks have emerged, many of the banking concerns triggered by a potential Brexit will compound already widespread issues. Bernstein’s note, for example, says the housing market is “already overheated”.

The prospect of investment banking job losses, meanwhile, is not new; banks have retrenched this year, including Nomura cutting more than 500 of its UK staff in April.

“Whether you have Brexit or you don’t have Brexit, it’s an absolute certainty this year is going to be a washout for investment banking,” says Chirantan Barua, an analyst at Bernstein. “Whoever had to refinance at zero interest rates in the last five years has done it. No one is in a rush to put capital to work. So where do you make money as a capital markets guy?”

An even more worrying prospect is the ongoing phenomenon of negative interest rates, which helped fuel an intense sell-off in bank shares in the first quarter. The volume of negative-yielding government debt rose above $10tn for the first time this month.

One advantage for most UK banks ahead is that their capital positions have strengthened dramatically over recent weeks. This year, transformational new rules for failing banks, known as the “bank recovery and resolution directive”, have also been introduced to shore up the industry.

Given the rules ultimately coming from Brussels, the UK’s regulatory future is potentially affected by a leave vote. “Post-Brexit, the UK would in theory be able to repeal all BRRD-implementing legislation,” says Ashurst, the law firm, although it adds that UK is an advocate of the new approach.

It is improbable such nuances are reflected in recent, sentiment-driven gyrations for bank stocks. “On average, markets don’t want to bet on politics because no one has an edge. Stocks go up 10 per cent, but no one’s winning,” says Mr Barua. “No one put on that bet.”

The Euro Stoxx banks index is still down about a fifth this year. The share prices of RBS, HSBC and Barclays are still down double digits in 2016.

“The problems are there — Brexit or no Brexit,” says Sam Theodore, director in financial institutions at Scope Ratings. “There’s a secular decline in wholesale investment banking. I don’t think that’s coming back.”

Comments