HNA chief shrugs off regulatory and ownership concerns

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

To hear HNA Group chief executive Adam Tan tell it, the Chinese company he runs is on top of the world. After a ferocious deal spree, the sprawling conglomerate that started out as a domestic airline operator on the island of Hainan has climbed to 170th on the Fortune 500 list of the world’s biggest companies.

To celebrate the occasion, HNA on Monday invited politicians, including former UK prime minister David Cameron and former French president Nicolas Sarkozy, to a celebration near Westminster in London, a prelude to an evening banquet at Hampton Court Palace. The company debuted on the Forbes list in 2015 at number 464.

But HNA’s stunning ascent has been dogged by questions about its opaque ownership structure and questions about its financing. In a remarkable concession, the company on Monday revealed that its official shareholding had not reflected its true ownership.

The disclosure comes as HNA faces a determined crackdown by Chinese regulators. During the past month, HNA along with three other top private dealmakers — insurer Anbang, retail conglomerate Fosun and property-to-entertainment group Dalian Wanda — have come under intense scrutiny amid concerns that uncontrolled capital outflows, using money raised from shadow financing, pose a systemic risk to China.

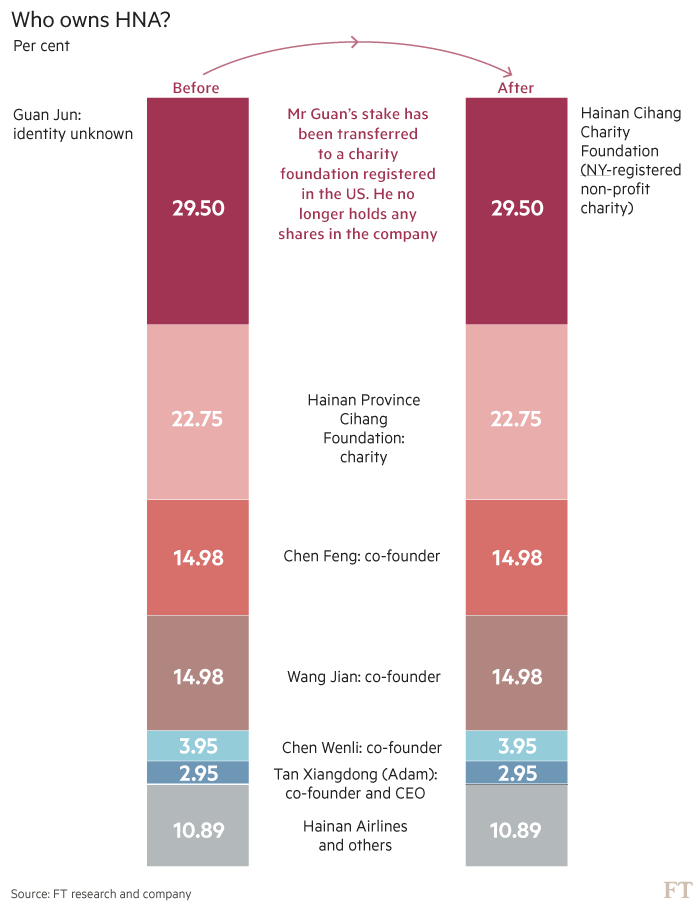

In an extensive interview, Mr Tan told the Financial Times that a shareholding restructuring that replaced mysterious Chinese shareholder Guan Jun with a New York-registered non-profit simply made public the true state of HNA’s ownership: “Originally, it has been outside China for tens of years. Because we are a private company, we don’t want to disclose our shares,” Mr Tan said. “But right now, we are so happy at 170 [on Fortune]. I think I trust the US government, I trust the Chinese government. I think it’s the right time to disclose the structures.”

As Beijing cracks down on capital flows, HNA also has been under fire from another source: Guo Wengui, an exiled businessman, has lobbed accusations from his Manhattan apartment that the family of Wang Qishan, China’s powerful anti-corruption tsar, enjoyed benefits from hidden ties to HNA. HNA has repeatedly denied these allegations.

An FT investigation in June that detailed HNA’s shareholding structure for the first time reflected “old information”, Mr Tan said, without specifying when the transfer from Mr Guan to the New York-based non-profit had occurred. Mr Guan’s stake was previously held by Hong Kong-based businessman Bharat Bhise.

"The [29.5 per cent] stake is our [HNA's] own stake. For the whole time. They [Mr Guan and Mr Bhise] had just held the stake for us. That’s why I can move the shares,” Mr Tan said.

He has worked for HNA and its affiliates since 1991, when Hainan Airlines was founded under the auspices of an office set up to channel World Bank loans to Hainan Island, at the time a Petri dish for China’s experiments with economic reforms.

Mr Tan is now HNA’s fourth-largest individual shareholder, with 2.95 per cent. Founder Chen Feng — who worked under Wang Qishan in the 1980s at an agricultural trust company channelling funding to the rural sector — and chairman Wang Jian each hold about 15 per cent.

Mr Tan denied that Beijing regulators have crimped HNA’s style: "I don’t feel pressure from the Chinese government,” he said. “I don’t know whether the other people feel pressure. I don’t speak for them. I don’t feel pressure because for 24 years I’ve been reviewed by the CBRC [China Banking Regulatory Commission] and different government authorities many, many times.”

People within HNA have told the FT that the company has put new deals on hold in the face of the scrutiny. But Mr Tan shrugged off any suggestion the buying spree is over. “We may do things more cautiously. But anything related to One Belt, One Road and the Chinese government is in full support of that. So a lot of things can happen,” he said, referring to a Chinese initiative for infrastructure investment in about 60 different countries.

In Europe, regulators are taking a second look at the company’s purchase of just under 10 per cent of Deutsche Bank, Germany’s largest lender. “We did everything legally. With the bank, with the structures, the regulations. We are fine. We are happy to be reviewed by them if they want,” Mr Tan said.

He called reports that some domestic Chinese lenders were reducing their exposure to HNA false and cited strong backing from western banks such as JPMorgan Chase, Morgan Stanley and UBS.

He said he had recently written to Bank of America’s chief executive Brian Moynihan, following reports that the US bank has cautioned its employees against doing business with HNA — but noted that Bank of America had in the past done very little work with the company.

“I said, what happened? I don't know you. Why have you people said very bad things about us?” Mr Tan said he wrote. “This is ridiculous. But anyway BofA is still one of the great banks in the whole world. It's first class. OK, maybe second class."

Bank of America declined to comment.

Additional reporting by Sherry Fei Ju in Beijing

Comments