Jes Staley hits roadblock in clean-up of Barclays

Simply sign up to the UK banks myFT Digest -- delivered directly to your inbox.

Jes Staley’s appointment as Barclays chief executive in 2015 ignited concerns of a throwback to the bullish leadership of Bob Diamond, the American investment banker who quit the lender five years ago as a result of the Libor rigging scandal.

But as well as improving the performance of its ailing investment banking unit , Mr Staley, another American who spent his career at JPMorgan, told staff when he arrived that he would focus on making Barclays a “values-driven organisation which conducts itself with integrity at all times”.

Despite signs of success in Barclays’ investment bank and overall group performance, Mr Staley has hit a significant obstacle in his efforts to complete the clean-up started by his predecessor, Antony Jenkins, a retail banker who took over from Mr Diamond.

On Monday, Mr Staley found himself at the epicentre of a fresh controversy less than 18 months into the top job, which raises questions over his role.

The chief executive is under investigation by UK regulators for trying to uncover the identity of a whistleblower. He faces a “very significant” pay cut, and sanctions from the Financial Conduct Authority and Bank of England for breaking whistleblowing rules.

The investigation is a setback for Barclays as it attempts to restore its reputation following numerous scandals since the financial crisis, which include Libor rigging and an ongoing criminal probe over the bank’s Qatar rescue deal in 2008.

“It was a moment of madness. An emotional overreaction,” says one person briefed on the investigation.

————-

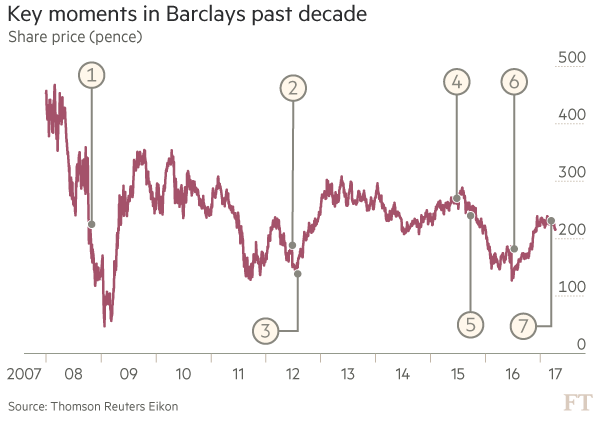

1. Oct 2008

Barclays turns to Qatari and Abu Dhabi investors in £7.3bn cash call

2. Jun 2012

Barclays fined a record £290m for Libor manipulation

3. Jul 2012

CEO Bob Diamond forced out amid scandal

4. May 2015

Bank agrees to pay $2.3bn for rigging forex and other markets

5. Oct 2015

Jes Staley named chief executive

6. Jul 2016

Three former Barclays bankers found guilty on Libor

7. Mar 2017

FCA relaunches probe into Barclays’ 2008 cash call

————-

However, people who know Mr Staley well have described him as typically thoughtful, low profile and methodical, in sharp contrast to Mr Diamond’s more hard-charging nature.

One UK-based investor in Barclays says: “He is straight talking. He cited previous experience at JPMorgan to convey his ability to tackle the issues at Barclays. He is big on controlling technology to reduce costs and complexity.”

In a memo to staff on Monday, Mr Staley wrote that he “got too personally involved in this matter”.

He said that the allegations in the whistleblower’s correspondence “related to personal issues from many years ago, and the intent of the correspondents in airing all of this was, in my view, to maliciously smear this person”.

Gary Greenwood, an analyst at Shore Capital, says that Mr Staley’s actions were a “shoot yourself in the foot moment” that “[casts doubt] on how much the culture has actually changed,” given the bank’s history of regulatory misdemeanours.

However, one person close to the bank board, who wished to remain anonymous, tells the Financial Times: “The board has rallied around him; they are going to protect him. Generally he’s considered to be good for Barclays and therefore they would like him to stay.”

Mr Staley was poached from Blue Mountain Capital, the US hedge fund he joined in early 2013 after a career of more than three decades at JPMorgan.

He has simplified and crystallised Barclays’ strategy, by unveiling a new structure last year with a commitment to the investment banking division. As part of the vision for a transatlantic bank that focuses on UK retail, European and US investment banking and credit cards, Mr Staley is selling its Africa business.

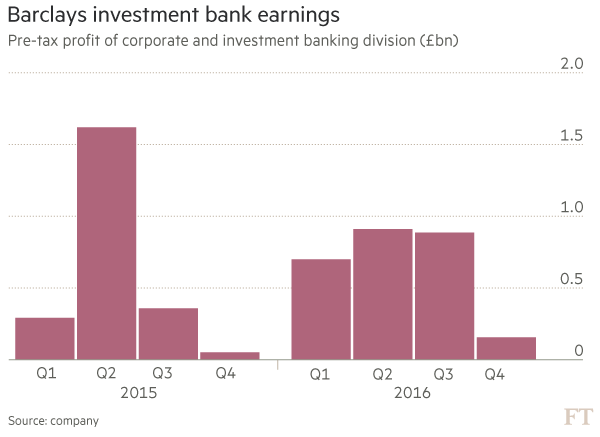

So far, the financial results back his conviction. Last year, the investment bank significantly contributed to the growth at Barclays’ international division, where profits rose to £4.1bn from £2.3bn in 2015.

The investment bank has also risen one place to the world’s seventh biggest, edging out Credit Suisse, according to the latest revenue-based rankings from industry monitor Coalition.

Joseph Dickerson, an analyst at Jefferies, says: “It sounds like morale is high under Jes, especially in the capital markets business.”

During his time at JPMorgan, Mr Staley rose to head its investment bank and was at one time seen as a contender to take over from Jamie Dimon as chief executive.

He was among a clutch of JPMorgan bankers, such as Michael Cavanagh, viewed as potential heirs to the throne, but who left to take on chief executive roles elsewhere.

Since joining Barclays, Mr Staley has poached a group of former JPMorgan senior managers, including Tim Throsby, who was appointed last September to head up the investment bank. Mark Ashton-Rigby was recruited a month earlier from JPMorgan as chief information officer, after Paul Compton was named as group chief operating officer and CS Venkatakrishnan as chief risk officer.

——————

More on Barclays regulatory investigation

News: Staley censured for attempt to identify whistleblower

Lex: Barclays pressure point

Alphaville post: Jes Staley, Barclays’ rogue CEO

Staley email to staff: Chief issues response to colleagues

——————

One former Barclays senior manager says that Mr Jenkins “elevated people from inside, getting rid of people closely associated with [Mr Diamond] but without bringing in significant new blood. Since Jes has come in, my impression is he’s brought in a whole range of new blood. It’s very positive, because that’s the way they transform things . . . they didn’t transform before because of political infighting.”

Comparisons have been drawn between Mr Staley and Bill Winters, a fellow JPMorgan alumnus who left in 2009 and is now chief executive of another UK-listed bank, Standard Chartered.

Samuel Johar, chairman of headhunter Buchanan Harvey & Co, says that Mr Staley was “not as charismatic as Bill Winters, more solid and steady. He’s East Coast preppy, into sailing.”

Investors signalled support for Barclays following the announcement of the investigation. The bank’s share price initially dipped on Monday morning from 215p to 213p, before rebounding to 216.20p at the close as fears eased that Mr Staley’s job may be at risk after the board said it supported him.

Nevertheless, the fresh scandal again intensifies regulatory scrutiny on Barclays, holding back its attempts to break from its troubled past.

Additional reporting by Laura Noonan and Patrick Jenkins

Comments