GlaxoSmithKline: Out of step

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

As Britons were voting to choose a new government last Thursday, another election was taking place footsteps from parliament. In the Queen Elizabeth II conference centre opposite Westminster Abbey, shareholders of GlaxoSmithKline gathered to anoint Sir Philip Hampton as new chairman of the UK’s biggest drugmaker.

It was the usual annual meeting crowd of pensioners enjoying a day out alongside activist investors eager to lob awkward questions at the board. Yet, as Sir Christopher Gent made his farewells after a decade in the chair, the sense of upheaval was almost as strong as the political convulsions unfolding across Parliament Square.

Witty questions rivals’ chasing M&A deals

Witty warns ‘poor choices’ being made and not all medicines being snapped up will pay off

Full story

Sir Philip has been called in, as he was at Royal Bank of Scotland and J Sainsbury before, to fix an ailing giant of British business. Revenues last year were almost 6 per cent lower than when Sir Andrew Witty took over as chief executive in 2008, while earnings were 9 per cent down. Shares in GSK have underperformed the broader pharmaceuticals sector by 80 per cent during the same period. Tim Anderson, analyst at Bernstein, says the company has been in “slow-motion freefall”.

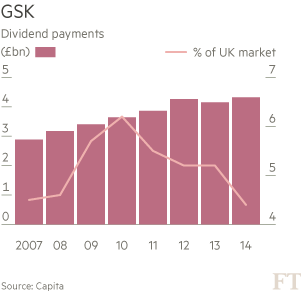

The multitude of knights of the realm in the GSK boardroom hints at the company’s importance to the UK. Only HSBC, BP and Shell are larger by market capitalisation among the FTSE 100 blue-chips. If Sir Philip’s rescue mission at RBS was critical to Britain’s financial stability, his next job is arguably as important to its science base, not to mention the pension funds for which GSK’s high-yielding dividend is a mainstay.

His first big call will be to decide whether the chief executive who has presided over its recent struggles is also the man to lead its turnaround. Sir Andrew is a 30-year GSK veteran, having joined as a management trainee from university. This makes him a popular, even beloved figure inside the company. “He’s an inspirational leader,” says Stuart Dollow, an industry consultant who used to work for GSK. “He’s the kind of guy who can talk for 45 minutes without notes and keep everyone engaged.”

Investor rebuke

Yet none of this has earned the GSK chief executive much credit from investors. Critics accuse him of failing to replenish a drugs portfolio that counts the declining Advair asthma medicine as its best-selling product 14 year after it was launched. A high-profile bribery scandal in China, meanwhile, led to a £300m fine, with the risk of further penalties from the UK’s Serious Fraud Office and the US justice department. This would have been embarrassing for any executive; for Sir Andrew, the self-styled champion of higher ethical standards in pharma, it was a humiliation.

“Witty is a man of great quality and integrity but there’s been some bad mistakes,” says a former top executive at another big drugmaker. “It needs someone to come in and take some tough decisions. The company’s reputation in the market has been badly eroded.”

Sir Philip has not shirked from ruthless decisions in the past, including the ousting of Stephen Hester as RBS chief executive in 2013. In his first public comments after becoming GSK chairman, he expressed hope that Sir Andrew would be “here for a good while to come”. But both men know this support will be difficult to sustain if performance does not improve.

The embattled chief executive made his case to investors last week, promising that a “fundamental shift” in GSK’s strategy would revive growth in 2016 after one more year of decline.

Sir Andrew’s plan is aimed at tapping rising demand for healthcare from the billions of new consumers in emerging economies such as China and Brazil, while reducing dependence on the developed world where fiscal and demographic pressures are set to put a lid on pricing.

In an interview, Sir Andrew defended his turnaround efforts, saying GSK was positioned to benefit from powerful long-term trends in global healthcare. “The challenges of last year crystallised the need to have a strategy which isn’t totally dependent on price levels in the developed world,” he says, referring to the sharp US decline in Advair, which is the main source of GSK’s problems.

He wants to shift focus from high-priced prescription medicines to more high-volume, affordably priced products aimed at the growing middle classes of the developing world. This was the rationale behind last year’s $20bn asset swap with Novartis, in which GSK traded cancer drugs for vaccines and consumer products.

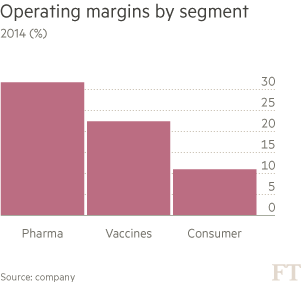

Critics have questioned the wisdom of leaving one of the most high-margin, fastest-growing parts of the pharmaceuticals market in favour of toothpaste, headache pills and flu jabs. Sir Andrew is unrepentant. He argues that, whereas GSK lacked the scale to compete in the crowded oncology field, the deal has bolstered the company in areas of strength. It is now the biggest company by sales in both vaccines and consumer healthcare.

“There are going to be more people in the world and they’re going to be older and they’re going to have more demand for healthcare,” says Sir Andrew. “But the growth in volume is going to be at lower prices.”

Industry outlier

This approach puts GSK at odds with prevailing industry sentiment. After a long innovation drought, drug development pipelines are bursting back to life with breakthroughs in cancer, hepatitis C, heart disease and a range of other conditions. The US Food and Drug Administration last year approved 41 new drugs — the highest annual tally for 18 years and the second-highest ever. This increased output has helped drive the S&P pharmaceuticals index up by a third in the past year, even as GSK shares fell by 8 per cent.

GSK has not entirely missed the revival. Indeed, it has won more new drug approvals in the past three years than any other company — including its fast-growing Tivicay HIV drug. But collectively they have failed to fully compensate for the decline of Advair. As one senior pharma analyst says: “They’ve had a lot of shots on goal but they’ve been ping-pong shots.”

Some critics see the shift towards lower-value products as an admission of defeat. “It is tempting to feel that GSK is hedging against future shortfalls in its own R&D efforts,” says Mr Anderson, adding that the “annuity-like nature” of vaccines and consumer healthcare would turn the company into “a bond with a nice yield”. “GSK should be capable of offering more than this.”

Sir Andrew insists there has been no retreat from innovation. The company still invests £3.5bn a year in research and development — roughly in line with the industry average at 15 per cent of revenues. It has 40 experimental medicines in late-stage trials. Last week, it became the first big drugmaker to seek regulatory approval for a gene therapy — an important new treatment class for genetic disorders, in this case for a rare childhood disease called Adenosine deaminase deficiency.

But while GSK will continue prospecting at the cutting edge of medical science, the company is becoming less dependent on this high-risk, high-reward game. Prescription drugs have fallen from 67 per cent of sales before the Novartis deal to 59 per cent.

“We leave open the upside potential to be one of the winners from innovation,” says Sir Andrew. “But it can’t be a one-way bet.”

American shifts

Sensible as this might sound, such views are near heresy in an industry whose economics rest on extracting premium prices in the US, which generates almost 40 per cent of global drug sales despite accounting for just 5 per cent of the population.

Few people dispute that the American market is getting tougher but the response of other drugmakers has been to double down on innovation to come up with higher value products. This explains the recent rush of multibillion-dollar acquisitions of up-and-coming biotech companies, as bigger groups compete for new medicines.

Many of the deals have been targeted at rare diseases or hard-to-treat types of cancers, where companies must charge high prices to make a return on investment from small numbers of patients. Alexion of the US last week agreed to pay $8.4bn for Synageva Biopharma, a company with almost no revenues, which is developing a treatment for a genetic disease that afflicts just 3,000 people in the developed world.

Sir Andrew warns that a fixation on chasing ever-higher prices from ever-smaller patient populations risks undermining the industry’s social legitimacy.

“If we end up with a situation where more and more of the resource is being deployed on fewer and fewer people, that surely creates its own tension that leads to some kind of change.”

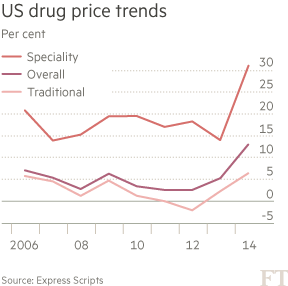

Some industry leaders think his warnings are overblown, pointing out that US pricing remains strong overall. Spending on prescription drugs increased 13 per cent last year, the largest jump for more than a decade, according to Express Scripts’ drug trend report. For Sir Andrew, this surge simply increases his conviction that a reckoning is coming as the US tries to squeeze more efficiency from the 18 per cent of gross domestic product spent on healthcare.

One senior healthcare analyst says GSK’s conservative strategy would have been ideal five years ago when the market was feeling risk-averse, but it is out of step with a renewed appetite for science and innovation.

“It’s as if GSK is playing string music just as the market is getting into drum and bass,” he adds.

Some investors would like to see GSK broken up. “Glaxo is a collection of good businesses that would be better off separate rather than mashed together in one box,” says a top 20 shareholder.

Sir Andrew acknowledges the Novartis deal has opened this option by leaving GSK with three businesses — pharmaceuticals, vaccines and consumer — that each have “sufficient scale to have a credible life on their own”.

But he says there are benefits to keeping them together and there would be “no logic” in a split before the units acquired from Novartis have had time to bed in. His record suggests that Sir Andrew is unlikely to be the man to tear apart the group in which he has spent his entire working life.

“When you get the opportunity to be the chief executive of the company you joined from university it is a special feeling,” says the 50-year-old. “It’s not like you’ve been hired in as a mercenary . . . it is your company.”

Sir Philip, on the other hand, is the ultimate hired gun. Sir Andrew knows he has little margin for error if his new boss is to keep his finger off the trigger.

***

Bribery scandal: Fixing reputation in China fits broader ‘social’ vision

Of all Sir Andrew Witty’s trips this year, his visit to Beijing in March may have been the most important. In his first public speech in the country since GlaxoSmithKline’s Chinese corruption scandal, he stressed the company’s commitment to China and detailed its efforts to clean up from past misdeeds.

Days before the visit, GSK let it be known that more than 100 staff had been dismissed in relation to the episode for which the company was fined £300m. The aim was to draw a line under a disastrous episode and begin the process of rebuilding its business in one of the world’s biggest and fastest-growing drug markets.

“We made it very clear we were embarrassed by what happened in China,” says Sir Andrew. “We’ve spent a lot of time understanding what went wrong and to make sure we fix it.”

The China scandal was embarrassing for Sir Andrew because of his vocal advocacy for transparency and social responsibility in the pharmaceuticals industry. He has opened clinical trial data to greater scrutiny, cut the link between prescriptions and bonuses for salesmen and called a halt to paying doctors to speak on GSK’s behalf at conferences from next year. All these steps have gone further than its rivals.

Sir Andrew says GSK’s strategic focus on high-volume products, such as vaccines, which can bring widespread health benefits at affordable prices, is part of the same broad effort to build a company that “fits in with society”. During the Ebola epidemic last year, he was at the heart of GSK’s push to develop of an emergency vaccine for the virus.

This public spirited approach has earned him many fans in governments and health organisations around the world. But the China scandal revealed a disconnect between his lofty rhetoric and behaviour in the field. And his good corporate citizenship will count for nothing unless he can show that it also benefits shareholders.

. . .

Letter in response to this article:

Innovation and scale fuel growth in Big Pharma / From Michael Fernandes

Comments