Investment focus: Oil on the slide

Simply sign up to the Oil myFT Digest -- delivered directly to your inbox.

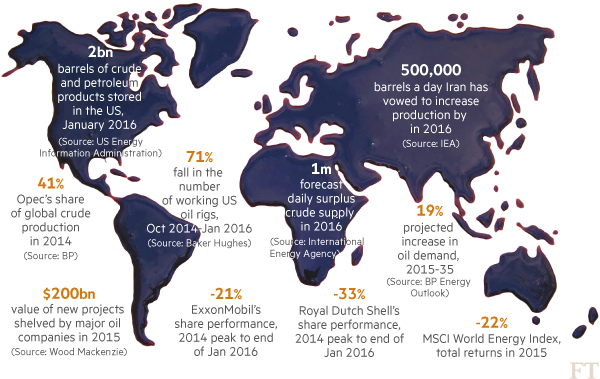

The dynamics of global supply and demand have provoked a relentless fall in oil prices. From $115 in mid-2014, barrels of benchmark Brent crude traded below $30 this January — their lowest in 12 years.

There have been winners and losers from plunging oil prices. Investors in oil companies, whose profits have been hit by lower margins, have fared badly. The MCSI World Energy index, which is dominated by the largest listed oil groups, delivered negative returns of 22 per cent in 2015.

And it could get worse. Investment banks have forecast that slowing demand from China and other major developing economies will combine with more supply, following the re-entry of Iran into the international markets, to drive prices towards $20 a barrel. Standard Chartered went as far as saying even $10 per barrel was possible before any sign of recovery.

Roughly $200bn worth of new projects has been shelved, however, curbing supply growth for the coming years. In the US, the shale industry, which accounted for two-thirds of net crude supply growth from 2009 to 2014, has been cutting production since last summer.

For oil “bulls”, the long-term value proposition currently offered by shares in the oil majors and other plays on the oil price, such as dedicated exchange traded funds, looks compelling. Calling the bottom of the market is always a dangerous game, but there is one guarantee for those who buy into black gold — volatility.

Adam Palin is a reporter for FT Money

Comments