Scotland after the vote: investments

![Eilean Donan Castle...[UNVERIFIED CONTENT] Eilean Donan Castle under a dark sky on an island in Loch Duich in the Highlands.](https://www.ft.com/__origami/service/image/v2/images/raw/http%3A%2F%2Fcom.ft.imagepublish.upp-prod-eu.s3.amazonaws.com%2F630ecd10-3a77-11e4-bd08-00144feabdc0?source=next-article&fit=scale-down&quality=highest&width=700&dpr=1)

Simply sign up to the Currencies myFT Digest -- delivered directly to your inbox.

Could the residents of Scotland really vote in favour of independence next week? For months, the prospect has seemed a remote one, at least to those living south of the border. But not any longer.

A YouGov poll on Sunday put the Yes campaign ahead for the first time and although subsequent opinion polls have shown the No camp ahead again, it is clear that the contest will be far closer than once supposed.

Investors have taken note. Sterling fell sharply in the first part of this week, while gilt yields edged higher and shares in companies with significant exposure to Scotland came under pressure. There was anecdotal evidence that some Scottish residents are moving capital into English banks.

A charm offensive from Westminster, a series of warnings from leading UK companies, and a clear statement on currency-sharing from the governor of the Bank of England steadied financial markets later in the week. But for the first time, those in England, Wales and Northern Ireland are starting to ask whether they need to prepare for the possibility of a Yes vote.

Here are some of the most-frequently asked questions, and answers based on what is known about the likely consequences.

Investing

The growing momentum of the pro-independence camp has prompted volatility in financial markets, with sterling falling and some shares with Scottish exposure also losing value. But what changes, if any, should investors in Scotland – and for that matter in the remainder of the UK – make to their portfolios ahead of the vote?

Sterling dived initially after polls pointing to a Yes vote. Should I be worried?

The declines in the pound have been the most visible manifestations of the shift in opinion polls, although Matthew Beesley, head of equities at fund manager Henderson, says this is as much about dollar strength as sterling weakness.

However, it has little short-term impact on UK residents, whose incomes and outgoings are all in the same currency.

For investors, it could even be beneficial; a weaker pound means capital gains and income remitted from overseas are worth more in sterling terms; for this reason, wealth manager Nutmeg has recommended that UK-based investors switch into funds (or classes of funds) that do not hedge their currency exposure.

Companies such as GlaxoSmithKline, Royal Dutch Shell and BP – whose shares are popular with retail investors – declare dividends in dollar terms, and those payouts will be worth more to UK-based investors. “The FTSE 100 is a net beneficiary from a weaker pound,” says Mr Beesley.

However, he and many others recommend that investors pick shares on company fundamentals, not exchange-rate forecasts. “Exchange rates are very difficult to call. Who knows what the euro will be worth in a year’s time? It’s very unwise to invest on the basis of what might happen to the exchange rate,” says Paul Taylor, managing director of financial adviser McCarthy Taylor.

I live in Scotland. What will happen to my Isa?

Treasury rules currently prevent those living overseas – except members of the armed forces – from contributing to Isas, although contributions made while resident in the UK can remain invested.

“We would expect a Scottish version of the Isa to be launched at some stage and it follows there could be some form of ‘grandfathering’ of UK Isa savings into any Scottish version,” says Tom McPhail, head of pensions research at financial services group Hargreaves Lansdown.

——————————————-

Shares

I live in England, but I own shares in Scottish companies. Should I sell them?

Most advisers think not. “There are some practical implications [of a Yes vote] but none is especially immediate. There will be around two years of negotiations,” says Jane Sydenham, at wealth management firm Rathbones.

“The long-term investor stands back from the noise,” says Mr Beesley.

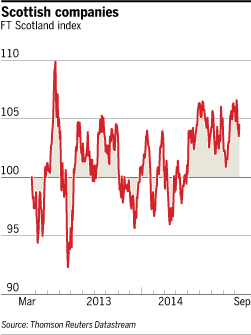

Although some share price movements have created headlines, the aggregate impact has not been that large. The FT Scotland index, which tracks the prices of 25 Scottish companies (excluding investment trusts) whose shares trade in London, is still above its starting level on March 21 2013 – when the date of the referendum was announced.

Shares in Standard Life, the insurer and asset manager, fell 2.4 per cent after the first poll putting the Yes campaign in front appeared. But at 410p, they are still above where they were before the company announced a £1.75bn return of capital to shareholders last week.

“Look at BG. Of all the oil majors, it has the most exposure to the North Sea. Yet the biggest drivers of its share price will be what happens in Brazil and Australia,” says Mr Beesley.

Will there be a big relief rally if there’s a No vote?

Many expect sterling to recover some of its recent losses. But others think markets will just find something else to fret about. “I’d be just as worried if No wins, as the main parties seem to be offering just about anything [to keep Scotland in the union] at the moment. It’s not clear what that will do to the rest of the UK’s tax base,” says Mr Taylor.

“The cat is out of the bag now,” says Mr Beesley, who pointed out that the close result in Canada’s Quebec referendum in 1995 meant the issue remained on the table and continued to affect corporate investment decisions.

Scotland after the vote

Another country’s money

Property & MortgagesUncertainty dogs the market

FT Money podcast

Scotland special

Would there be a Scottish stock exchange?

There was one in Glasgow, up until 1973 when all regional exchanges in the UK closed. A study by Paul Marsh and Scott Evans this year noted that 32 countries have become independent or emerged from Communism since 1989, and 30 of them established (or re-established) exchanges, with varying success.

“Scotland has a distinct advantage of many of these countries in that it has a long history of successful private and publicly listed companies,” they noted. Based on companies already traded in London, a Scottish exchange could rank 28th in the world.

But investors tend to follow the liquidity. Professor Marsh and Mr Evans pointed out that the Irish stock exchange has steadily been losing its biggest companies to either London or New York. A Scottish exchange “would need to entice companies away from the large, liquid, international London market to a new, untested Scottish exchange”.

——————————————-

Funds and trusts

What will happen to funds and investment trusts domiciled in Scotland?

No one knows. Ian Sayers, director-general of the Association of Investment Companies, says that given the strong international competition for fund domiciles, an independent Scotland would be likely to adhere to the same legal and fiscal structures as the UK, at least to start with.

Scottish Mortgage Trust, one of the larger investment companies based north of the border, told shareholders this year that in the event of a Yes vote, it envisaged a lengthy transitional period and that it “will have ample time to assess the economic, political and regulatory landscape which might emerge”.

What about gilts?

The uncertainty around separation following a Yes vote would slow business investment, according to economists at Axa Investment Managers, who predict that 2014 economic growth would be curtailed by 0.25 per cent, and by 0.75 per cent in 2015, prompting the Bank of England to defer any interest rate rises. “We expect gilt yields to be around 30-40 basis points lower over the coming three years in the event of a Yes”.

However, Ms Sydenham says the interest-rate outlook, the UK general election and the possibility of a UK withdrawal from the EU would have more bearing on gilt yields in the medium term than the result of the Scottish vote – and many advisers already believe that government bonds are is overvalued given the likelihood of rate rises in the UK and US.

Comments