Waiting for Janet — currencies market in thrall to Fed

Simply sign up to the Currencies myFT Digest -- delivered directly to your inbox.

Central banks have begun the year dancing to a Duke Ellington classic. Imagine US Federal Reserve chair Janet Yellen crooning “Do Nothing Till You Hear From Me”, and a host of governors, from Mario Draghi to Mark Carney, dutifully obeying.

Because until Ms Yellen and her colleagues have their say this week on oil, China and whatever other factors are contributing to 2016’s frantic start in the markets, policymakers’ best — and probably only — course of action around the world is, indeed, to do zip.

That might mean a loss of face for some central banks, such as Brazil and Canada that had primed the market to expect rate movement, yet which last week kept rates unchanged.

But in this state of high market anxiety, why pre-empt the Fed when all things so patently flow from what it says about market conditions, the dollar’s rise, the US economy and the US rate cycle?

All eyes will stay on the Fed, says Hans Redeker, Morgan Stanley’s head of foreign exchange strategy. Noting a US manufacturing slowdown — partly the result of dollar strength — and anticipating weaker labour market data, he fears a US economy sucked into the vortex of the rest of the world’s slow growth, and dare not contemplate what impact that would have on a frazzled market.

Ms Yellen “has to come up with a very good communication exercise”, says Mr Redeker.

Market ears will listen especially for what the Fed says about the dollar. A year ago, the reasons for dollar strength looked straightforward: the US economy was strengthening and the Fed was gearing up for hiking rates.

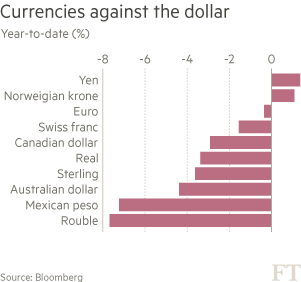

Three-and-a-bit weeks into the year, the trade-weighted dollar has risen more than 2 per cent. But the cause of this latest bout of dollar virility is more complicated.

Its rise is more to do with vulnerability of emerging markets and oil-dependent currencies, such as big US trading partners Canada and Mexico, the easing signals of Mr Draghi’s European Central Bank and market participants’ aversion to risk than with investors buying into US confidence.

“One only need look at the response to the December non-farm payrolls report,” say Bank of America Merrill Lynch strategists. They note how the dollar dipped against the yen despite one of the strongest payrolls data of recent years, as nervous investors sought haven currencies.

Contributing to the complexity is the gap in rate rise expectations between the market and the Fed. Interest rate futures point to rates staying where they are for the rest of the year. The Fed’s “dot plot” map of rate projections assumes four hikes in 2016.

On one hand, the market’s pushback on rate expectations in recent weeks “should cause the dollar to weaken”, says Michael Sneyd, forex strategist at BNP Paribas.

On the other hand, Mr Sneyd adds, that pushback is contributing to the dovishness of the ECB and may cause the Bank of Japan to ease monetary policy further, strengthening the dollar against the euro and the yen. “The theme of monetary policy divergence remains in place,” he says.

Ms Yellen’s more immediate concern may be the impact of a stronger dollar on the US economy. That’s bad for the manufacturing sector, which has already struggled from the impact of last year’s dollar rise, says economic strategist Anthony Karydakis at asset managers Miller Tabak.

“Yellen in her last two press conferences has said the dollar is a consideration because of the impact on exports and manufacturing. The dollar has been a consistent headwind to growth in the last year and a half, and it’s going to remain that way,” he says.

Amid much market confusion, investors are cautious even about an asset as all-conquering as King Dollar. The US economy is “OK, but not startling”, says Alan Wilde at Baring Asset Management. He expects the dollar to strengthen modestly over the course of the year, with no meaningful breaking of lows by the end of the year.

Marc Chandler at Brown Brothers Harriman describes the dollar as “flat but firm”. Recent US data has been “disappointing for sure”, he says, but it doesn’t herald the end of the US recovery. Personal consumption is holding up well and inflation is trending higher despite falling oil prices.

“I’m not sure the market’s idea of zero [rate hikes this year] is a better alternative,” says Mr Chandler.

Of course, the dollar’s strength may be tested if support returns for emerging market currencies, if China data improves consistently or if oil enjoys a sustained rebound.

Short of those turnrounds, the dollar is “the only place you want to be”, says Mr Karydakis. But if investors want further evidence, they should do nothing till they at least hear from the Fed.

Comments