Free Lunch: Plus ça change

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Free Lunch live on December 2: Martin Sandbu leads a conversation with Paul Johnson of the Institute for Fiscal Studies on UK state finances after the spending review. Buy tickets here.

Axes, taxes, and windfalls

The Financial Times front page has the most euphonious summary of Wednesday’s Autumn Statement by chancellor George Osborne: “Osborne swaps axe for tax”. That is the truth, though it’s not the whole truth.

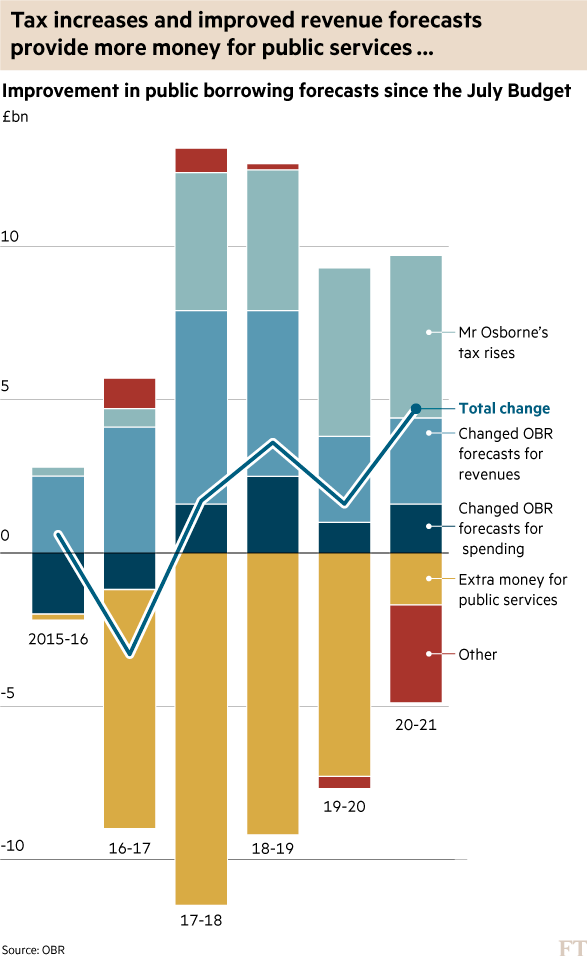

The axe-for-tax swapping refers to the fact that compared with the July Budget, Osborne now plans for spending cuts that are less swingeing and for new measures that are tax rises in all but name. On the tax side, there are not just new levies (the biggest one being an extra payroll tax linked to apprenticeship funding) but also a windfall of higher revenues from existing taxes than previously projected:

These revenue increases fund tens of billions of relative giveaways over the next five years. This is as tax-and-spend a move as they come — as long as we keep the emphasis on “relative”. There are still big cuts to be made in spending on public services, but they are not as big as they looked a few months ago (see the chart below). One might discern a pattern here: remember how Osborne aimed for a surplus of more than £20bn in last year’s Autumn Statement, which was later revised down to about £10bn? The strategy is psychologically acute: paint the scariest picture you can, than carry out something slightly less painful, and even the strongest fiscal consolidation on record will come as a relative relief.

The end point of the fiscal plans, however, is about the same as it was: it is the trajectory that is lighter to bear, not the destination that is less radical. That is the main message of Martin Wolf’s dissection of the chancellor’s announcements. And as the FT’s editorial highlights, even the chancellor’s near-complete capitulation on his desire to cut tax credits is a short-lasting respite for those on low incomes: soon tax credits will in any case be replaced by the new “universal credit”, for which similar cuts are going ahead.

The overall judgment on the Autumn Statement must therefore be “plus ça change, plus c’est la même chose”. The total fiscal consolidation due in the next five years is comparable to that carried out in the last five. The composition of the tightening is somewhat different: this time, more is sought to be achieved through tax rises and welfare cuts than through squeezing public services.

But the state is still set to shrink radically, public services are still to suffer deep cuts, and pensions will remain protected while non-pension welfare spending dries up to secure the savings the chancellor continues to pledge he will make. The reshaping of the state’s role in the economy continues as we described it on Monday. As Matt Whittaker of the Resolution Foundation puts it, “Osborne’s Britain is no country for young men” (or women) — an expanding share of state resources spent on the elderly is muscling out that devoted to children and young workers.

The remarkable thing is that Osborne manages to come across as flexible (if you support him) or weak and succumbing to pressure (if you don’t) even as he proceeds with what he’s been doing all along. In this sense, at least, his mantra of a long-term economic plan is valid. Beyond that particular piece of rhetoric, you will be more informed by watching what he does rather than what he says.

Other readables

- Whither Argentina after the Peronists’ election defeat at the hands of Mauricio Macri? FT reporters focus on his looming battles with the central bank and on international investors’ expectations for reform. Commentators show that Macri’s victory — and in which direction Argentina now turns — matters for the rest of the region. Andrés Velasco, Chile’s former social democratic finance minister, cautions against a simplistic view of Macri as a rightwing president.

To receive Martin Sandbu's Free Lunch by email every workday, sign up here.

Comments