Why luxury air travel is taking off again

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

British Airways’ Technical Block C does not have the feel of somewhere in the vanguard of luxury. A grey concrete block, built in the 1950s on the edge of the apron at Heathrow airport, it looks like a multistorey car park or rundown inner-city tower block. When I visit, signs on the doors warn that asbestos removal is under way.

The fourth floor is open plan and warehouselike, almost empty except for a small, locked room marooned in the centre. Inside that, and hidden beneath a dust sheet, is a single, top-secret prototype of the product BA hopes will secure its status as an industry leader – a brand new first-class seat.

It is elegant and sophisticated, without being ostentatious, the soft, hand-stitched “raven black” leather perhaps rather masculine. “An evolution rather than revolution,” says Kathryn Slack, BA’s cabin interiors manager. Beyond that, all details are strictly under embargo until it is revealed next year, ahead of entering service on the airline’s new Boeing 787-900 aircraft. But the simple fact that BA is investing in a new first class is indicative of a trend going on across the industry, one that many will find counter-intuitive.

. . .

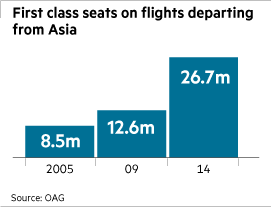

Even before the financial crisis, observers were predicting the death of first class. When recession took hold, it seemed a done deal. In fact, however, the opposite now seems to be true. An analysis carried out for the FT by the aviation data company OAG shows a significant rise in the number of first-class seats in the air. At the same time, airlines are launching new and ever more lavish first-class cabins – most noticeably, Etihad’s Residence, a three-bedroom private apartment which enters service next month.

The OAG data show a 34 per cent rise in the total number of first-class seats on planes departing in 2014 compared with 2009. Stripping out North American and Chinese domestic flights, where “first class” often equates to what would elsewhere be called “business”, the increase is 21 per cent. The number of first-class seats on flights within Europe fell sharply between 2005 and 2009, but has since rebounded, in 2014 reaching more than double the 2005 total.

“Everyone thinks first class must be diminishing, but its quite incredible how more and more airlines are renewing their first-class offer and having more first-class seats on board,” says Nigel Goode, director of the design agency PriestmanGoode, whose recent projects include new first-class cabins for Qatar Airways, Swiss, Lufthansa and Air France. “There is quite a resurgence.”

And yet the picture isn’t straightforward. “Absolute numbers are up, but it’s the composition that is the really intriguing thing,” says John Grant, executive vice-president at OAG. Look at individual airlines and you see big discrepancies. In China, where flying first has traditionally been an important status symbol for executives and politicians, as well as in the Middle East, carriers have rapidly expanded their first-class offering. However European airlines, and US carriers on international routes, have tended to scale back.

Over the past five years, first-class seat numbers have grown by 63 per cent on Air China and 127 per cent on China Eastern, according to OAG. In the Middle East, Qatar Airways has seen a 132 per cent rise, Emirates, 32 per cent. “The Middle Eastern and Asian carriers have really got something to prove, and first is such a statement about the overall quality of the airline,” says Goode.

By contrast Air France has cut capacity by 47 per cent since 2009, British Airways by 23 per cent. Celebrities and wealthy individuals have continued to fly first – and demand has been bolstered by some downshifting from private jets – but since 2008, executives have increasingly been downgraded from first to business by employers eager both to save money and to avoid appearing profligate.

“The other significant thing is how much business class has improved,” says Caroline Strachan, vice-president of American Express Global Business Travel, which manages travel for major corporations. “Ten years ago, you had to go first in order to lie flat; nowadays the majority of business classes have flat beds, so companies no longer need to pay the premium.”

. . .

So why are western carriers spending heavily on new cabins? In part, it is simply a response to the growing competition from the east. “We chose to have the best quality in the world, rather than the most quantity,” says Catherine Betsch, director of La Première, Air France’s new first class, which launched two months ago. Air France has cut the number of first-class seats on its Boeing 777-300s from eight to four much larger ones. As well as fighting harder for the diminishing western market, the airlines are seeking a share of the growing Asian one. La Première was launched not in Paris but in Shanghai, and Air France promises Chinese staff both on board and in its Paris lounge.

Meanwhile, an airline’s first also needs to compete with its own business class. “The business product now is as good as first four years ago, so the first-class offer has to improve exponentially in order to differentiate itself,” says Goode. The introduction of the double-decker Airbus A380 has spurred innovation by offering designers more space to play with, making it possible for Qatar, for example, to offer a large on-board lounge in its new first, launched last month. “Today if you’re going to do first class, you’ve got to do it properly,” says John Grant at OAG.

While airlines spend huge sums on each seat (“they can be the price of a small house” admits Goode), they are also seeking to differentiate on the ground. Lounges with spas and food by celebrity chefs are increasingly standard, but Air France, for example, now offers a private limousine transfer from lounge to aircraft while Lufthansa goes one better – its first-class passengers changing planes at Frankfurt can take a Porsche out for spin while they wait.

Such ideas might be just the start. “Looking forward, I’m particularly excited to see brands outside of aviation be invited in,” says Devin Liddell, principal brand strategist at Teague, the Seattle-based design consultancy. Delta, for example, last year began a collaboration with the hotelier Westin, offering its trademarked “Heavenly” bedding on board. “That’s just the tip of the iceberg in terms of what we’re going to see, particularly in first class. I mean, imagine the Gucci racing stripe on the Emirates first-class seat – there’s a lot of evidence that consumers are very compelled by those kind of partnerships, and will gladly pay a premium for it.”

Others, though, sound a more cautious note. With few headline-grabbing innovations and a 24 per cent fall in first-class seats on international flights since 2009, the US is noticeably out of step with other parts of the world. “It’s the inevitable trade-off – if you spend too much on the passenger, you won’t make money,” says Gerald Khoo, a transport analyst at Liberum. “Historically, the US has always led the aviation industry, and where its airlines lead, others tend to follow.”

——————————————-

Inside ‘The Residence’

The crisp linen and collection of pillows would not be out of place in a five-star hotel, writes Simeon Kerr in Abu Dhabi . But the belt strapped across the duvet marks this bedroom as somewhat out of the ordinary.

“The Residence”, a three-room suite that will enter service next month on Etihad’s Airbus A380, feels like a cabin on a railway sleeper or cruise ship.

I am being given a tour of the mock-up at Etihad’s “innovation centre”, located between Abu Dhabi airport and the capital of the United Arab Emirates, where staff training is in full swing. A Savoy-trained private butler will serve the Residence’s two guests with personalised gourmet meals, prepared by an in-flight chef, on gold-plated crockery.

The 125 sq ft suite, in the front of the upper deck of the A380, includes a tiny shower room dividing the lounge from the bedroom.

Costing $20,000 for a one-way trip between Abu Dhabi and London, the company hopes to target travellers who might otherwise spend $100,000 or more on a private jet.

“It is a cheaper way to travel in superior style,” says Peter Baumgartner, Etihad’s chief commercial officer.

Comments