London struggles to meet demand for homes

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

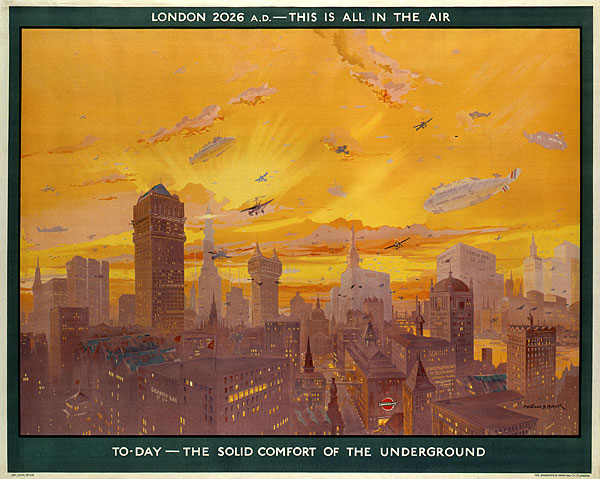

Making predictions is a perilous business. In a poster produced by London Transport in 1926, an artist imagined how the UK capital would look a century later: in this unrecognisable vista, the skies are filled with a multitude of small aeroplanes and airships, and the streets are overshadowed by unlikely brick-built skyscrapers.

The poster was included by Boris Johnson in his “2020 Vision”, a document setting out the long-term strategic needs of the city. While the London mayor pointed out where the early 20th-century transport planners went awry, he agreed with them in one important respect: London in 2026 is likely to be far more crowded, and its public services far more pressed, than its current inhabitants have ever experienced.

Population growth is central to any attempt to speculate on London’s distant future. Already nearing historic highs at 8.3m, the populace is expected to rise to 10m by 2031 – equivalent to adding an extra three boroughs. It had already grown by 12 per cent in the decade to 2011, compared with 7 per cent in the UK as a whole.

The capital’s schools and hospitals will feel the strain, with most of the rise expected to come from a growing number of births rather than immigration. But perhaps the greatest challenge facing the city in the coming decades is the question of where the extra people will live.

London housebuilding rates are at half the level needed to meet demand – put by Mr Johnson at 42,000 a year for at least the next decade. There is already evidence of overpopulation: some 12 per cent of people live in overcrowded conditions, as defined by the standard number of bedrooms per head. London’s average household size rose from 2.35 to 2.47 people over the decade to 2011, while the national average remained flat.

This mismatch of supply and demand has led to steep rises in the capital’s house prices. Figures last month from the Office for National Statistics put the rise in the year to September at 9.4 per cent, compared with a national figure of 3.8 per cent. A London home costs £434,000, on average, compared with £245,000 across the UK.

Mr Johnson last month launched a long-term strategy, proposing new incentives and powers to kick-start stalled housing schemes and encourage more low-cost homes – both to buy and rent – for low and middle income Londoners.

But with a recovery in the mortgage market, and London property continuing to attract foreign investment, the city is already undergoing a building boom across many areas. King’s Cross and the Nine Elms project around Battersea are two of the biggest brownfield sites. But another area of vibrant growth is east London, where the regeneration triggered by the Olympics – still a work in progress – has been followed by a string of proposed business and residential schemes.

East London’s Royal Docks, which fell into decline in the 1970s, is the centre of several projects, including the creation of an “Asian business port” by Chinese developers ABP. Oxley Holdings, a Singapore developer, last month bought the Royal Wharf site with permission to build 3,385 homes on the land, which agent Knight Frank said was the biggest site to come on the market since Battersea Power Station.

East of the City of London, Irish property developer Tom Ryan is proposing Europe’s tallest residential tower, a 74-storey skyscraper on the western side of Canary Wharf; to its east is Wood Wharf, an area for which 1,600 homes are planned, as well as retail and office space.

In spite of this acceleration of development, Newham is not yet Chiswick. Tony Travers, an expert on the capital at the London School of Economics and Political Science, says the old image of the East End as unfashionable and threatening has been dispelled. “But if you compare the perfectly nice terraced housing in east London with its equivalent in outer west London, it is still seen as less desirable.”

Population growth may change this, he adds, as young people will be forced to buy in the east. “The young are going to start living in Leyton and Ilford in a way that they used to live in Shepherds Bush or West Hampstead.”

The extent to which they are pushed further out of the centre – in whichever direction – will be influenced in part by the flow of foreign capital into London housing. Concentrated at the top end of the market, overseas demand has prised London further apart from the rest of the country in terms of property values.

According to figures from Savills, the estate agent, the 10 most expensive boroughs in London have a total property worth of £552bn, the same as Scotland, Wales and Northern Ireland combined. More than £7bn of overseas money went into prime London property last year, the agent said. The Treasury is watching the trend closely: the FT revealed last month it was considering taxing capital gains on foreign sales of British property, which UK citizens, but not foreigners, pay on any home that is not their primary residence.

But the role of overseas investment is hotly contested. Many believe there would be a price to pay if its flow were stemmed. A study for Berkeley Group, the developer, by Mr Travers and Professor Christine Whitehead of the LSE, said such investment was essential to the supply of affordable housing. Its loss would threaten improved infrastructure funded through planning obligations. “In short, international investors generate additional housebuilding, which relieves rather than exacerbates the pressure on housing supply,” the authors said.

The world has recognised London’s myriad qualities as a solid investment: but its appetite for the city may end up being something London can neither live with, nor without.

——————————————-

See James Pickford’s video on the groundbreaking – and controversial – funding of the massive Nine Elms development project: www.ft.com/nine-elms

Comments