How to buy a bargain high-end home in London – seek a short lease

Simply sign up to the Life & Arts myFT Digest -- delivered directly to your inbox.

Somewhere in Sloane Street an estate agent’s phone is ringing off the hook: those trawling the online property sites have spotted a bargain in Belgravia, and are clamouring to find out more.

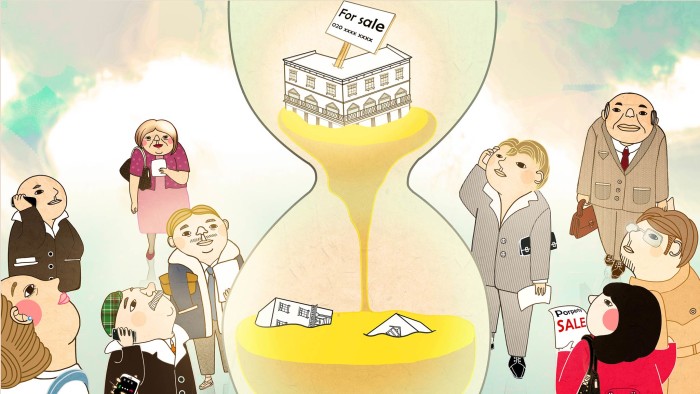

Their interest wanes swiftly when the agent explains the reason why the upmarket apartment in a premier London location is so keenly priced: the property has a “short lease”, meaning the purchaser will enjoy the right to live in it for a limited period – perhaps just a handful of years.

“You always get lots of telephone calls from people thinking, ‘Brilliant, I can buy a flat in Eaton Square for £600,000’,” says Christian Warman, a director in Savills’ Belgravia office. “Those calls fall off pretty quickly.”

Approximately 3m homes in England, mainly flats, have “leasehold” status, including many in London’s most expensive districts. From Knightsbridge to Marylebone, South Kensington to Bayswater, leasehold properties are commonplace. Rather than owning the property outright, the buyer leases it for a set period, after which it reverts to the “landlord” who owns the block or house that contains the apartment.

Generally the market prices “long leases” of 80 years or more as it does “freehold” properties, which allow the buyer outright ownership. Below this threshold values drop, since high street lenders are reluctant to fund leases under the 80-year threshold; depreciation accelerates as leases head towards zero.

While the idea of effectively owning a property for just a few years might spook the average buyer, property professionals are reporting increased demand for short-lease properties in prime London neighbourhoods – where the value of sub-£2m homes increased by 12.8 per cent in the 12 months to February, according to Knight Frank. “There is always a certain amount of them trickling on to the market and there’s always a following,” says Warman.

Rising interest is partly due to increased awareness of the rights attached to most short leases, says Natasha Rees, a partner at Forsters law firm. Owners of apartment leases that were originally at least 21 years in length can apply for a 90-year extension after two years’ ownership. They may even be able to acquire the freehold of their building, a process called collective enfranchisement. Both processes require the leaseholder to negotiate and pay a “premium” to the landlord.

“I’ve been doing enfranchisement for the last 12 years and the demand for short leases [in super-prime London] has steadily increased, firstly because there are so few short leases on the market and also because everyone’s become a bit more aware of enfranchisement,” says Rees.

Buying agent Robert Bailey reckons there are at present about 25 properties with leases under 40 years, and priced between £500,000 and £50m, for sale in London’s smartest areas. He says older people are often ready purchasers. “A lot of older people might say, ‘I don’t want to tie up £10m in a flat in Eaton Square’ when they could buy it on a short lease for maybe £4m and their estate or beneficiaries could extend the lease, or sell it with the knowledge that it could be extended, which gives it quite an additional value,” he says.

Such buyers might consider a ground-floor apartment in a purpose-built block on Hyde Park Crescent, five minutes’ stroll from the green expanse of the park itself and little further to Paddington’s mainline station. With 18 years left on the lease, the two-bedroom flat is on sale with Knight Frank for £750,000 – about £1m less than similar, long-lease properties nearby. A 90-year lease extension is possible thanks to an original lease of 70 years.

How much the buyer will have to compensate the landlord to extend is another matter. Lease extension premiums are calculated according to a complex formula and subject to negotiation with the landlord. Jeremy Dharmasena, a leasehold specialist at Knight Frank, says the question of what someone might pay “is a bit too open-ended”. The property’s quality, location and existing lease all enter the calculation; extensions can run to several million pounds for the best homes.

Estimates for extending a 43-year lease on a two-bedroom apartment, recently sold in Kensington, ranged from £300,000 to £750,000, says Andrew Phillips, central London sales director at Hamptons International. Ultimately, the property went for £2.3m, with extension terms settled by the vendor. Phillips reckons the flat might have fetched “just shy of £3m” with a long lease, but achieved about £300,000 more than it would have done without the extension secured before sale.

“We try to organise for the present owner to apply for the extension and pass the value and costs on to an incoming buyer: the seller will achieve a better price,” says Phillips.

Not so the vendor of the 29-year lease on a three-bedroom flat in the red-brick enclave of Chelsea’s Cadogan Gardens. The modernised, top-floor apartment covers 1,485 sq ft and benefits from a porter and private garden square. It is on sale with Hamptons International for £1.875m – without the lease extension, for which it qualifies, in train.

This may attract what Warman, of Savills, describes as “pay half now, half later” buyers who either can’t afford long-lease prices or wish to acquire a sought-after address without committing too much capital. “They might be relying on a bonus payment, or a company sale or inheritance to extend in two years’ time,” he says.

Extending by 90 years is not an option for whoever buys the £600,000 apartment Savills is selling on Eaton Square, perhaps London’s most exclusive address. The original 20-year lease on the two-bedroom flat, which has access to private gardens and a tennis court, prevents the owner from negotiating a lengthy extension with the landlord, the Duke of Westminster’s Grosvenor Estate, and this lease expires in 2022.

Dharmasena considers such arrangements often appeal to “overseas purchasers who want to have a prime London address . . . and recognise they can buy the property on a short lease at a discount. They accept that it’s a wasting asset”.

Warman takes a different view. “It’s predominantly an English domain; the sort of people who want to have an Eaton Square address on their letterhead but don’t necessarily have £2.5m,” he says. “When people invite guests over for dinner, they don’t necessarily know whether it’s a 20- or a 120-year lease. It’s a way of being a little bit more flash than you might otherwise be.”

——————————————-

Buying guide

What you can buy for . . .

£355,000 A 12-year lease on a three-bedroom flat requiring modernisation in a purpose-built block in Bayswater

£425,000 A 17-year lease on a one-bedroom, fourth-floor period apartment in Marylebone

£2.5m A three- to four-bedroom, Grade II-listed Belgravia apartment, three years into a 20-year lease

Comments