German 10-year bond yields heading below zero

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Germany’s benchmark 10-year government borrowing costs are on track to fall below zero for the first time, raising fresh concerns over the damaging side effects of the European Central Bank’s landmark bond-buying programme.

Yields on Bunds dropped to just 0.16 per cent on Friday, compared with 0.54 per cent at the start of the year, and as the ECB enters its second month of quantitative easing, many analysts think it could be only a matter of time before German 10-year yields drop below zero.

Switzerland — a much smaller market that is not part of the eurozone — last week became the first government in history to sell benchmark 10-year debt at negative interest rates, raising worries about distortions in global financial markets.

Negative yields in Germany would have much greater symbolic importance for the ECB, which holds a policy meeting in Frankfurt on Wednesday. They would highlight the shortage of the highest-quality European government debt caused in part by the ECB’s own buying programme.

Steven Major, global head of fixed-income research at HSBC, said that negative yields rendered conventional valuation techniques redundant. “They are like commodities such as barrels of oil — there is no coupon and you are taking a bet on their future price. This is not what bond markets are supposed to do . . . the whole thing is crazy.”

“It is really the squeeze from the ECB’s trillion-euro bond-buying programme, and would be an extension of the price dynamics we have seen already,” said Peter Goves, rates strategist at Citigroup, which is forecasting negative German 10-year yields by the end of June at the latest.

By pushing down interest rates and weakening the euro, the ECB hopes to avert a deflationary slump in continental Europe. However, negative yields mean investors in effect pay to lend their money to governments and are guaranteed a loss if they hold the bond until maturity.

“It is a tax on pension funds because they cannot get the required return,” said Christopher Iggo, senior manager at Axa Investment Managers.

Despite this, many investors have been reluctant to sell eurozone government bonds because they lack suitable alternative places to put their money. Since last June, the ECB has charged banks for parking funds in its “deposit facility”.

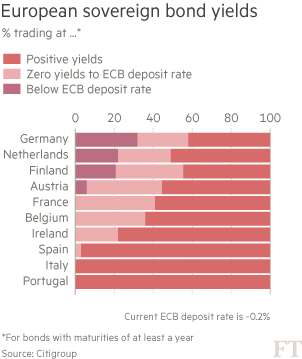

Some 57 per cent of all outstanding German government bond debt with a maturity of more than a year now trades at yields below zero, according to Citigroup. Almost a third trades below minus 0.2 per cent, a rate below which the ECB has said it will not buy assets.

A shortage of German debt could eventually force a change of tactics by the ECB. It has already said it will buy bonds issued by agencies such as the KfW, the German development bank, but will this week review the list of agencies whose debt is eligible.

Analysts said another option would be to buy the debt of German state governments. A more radical alternative would be to restore interest payments on the ECB’s overnight deposit facility — but that would be tantamount to an increase in official interest rates.

Comments