Investment focus: US presidential election

Simply sign up to the US trade myFT Digest -- delivered directly to your inbox.

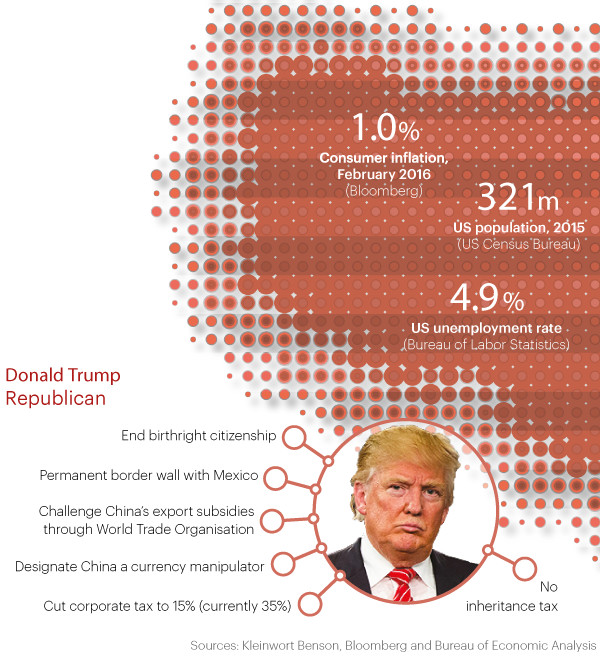

The spectre of Donald Trump winning the US presidency this year looms larger with every victory in the race for the Republican nomination.

And the world waits — nervously. The possible victory of the self-styled maverick was rated in March as the sixth greatest threat to global stability by the Economist Intelligence Unit — ranked alongside the threat of jihadist terrorism.

Yet Trump is not the only candidate whose hostility to free trade could spook investment markets. Democrat Bernie Sanders is also opposed to trade deals across the Atlantic and Pacific and has advocated reversing the well-established North American Free Trade Agreement, Nafta. Indeed, Hillary Clinton, the other leading candidate, has also failed to come to the defence of international trade.

Bill O’Neill, head of the UK investment office at UBS Wealth Management, says the hostility of presidential candidates towards free trade, and towards China in particular for alleged currency manipulation, is a source of particular uncertainty for investors.

With both main parties only confirming their candidates in July it is too early for markets to be led by the US election, fund managers say.

The 2016 election barometer will, however, increasingly define the year before November’s climax.

Note: the print version — which includes Ted Cruz — was correct at time of going to press.

Adam Palin is a reporter for FT Money

Comments