US student debt: Lessons to last a lifetime

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Jennifer Char went to Westwood College in Atlanta, dreaming of becoming a graphic artist. Today she is selling beauty products and wondering whether the two years she spent at the school, which will permanently close its doors next month, were worthwhile.

“I felt that some of the classes were more like electives [optional courses] for high school, or unnecessary for my degree,” she says, explaining that she left the course with too small a portfolio of work to show employers. “It was very upsetting. Why am I paying for something that is not going to be worth it?”

One legacy that Ms Char has not shaken off from her time at Westwood is debt. She says loan repayments of $400-$500 a month are consuming around half of her take-home earnings. She benefits from a forgiving landlord — her mother — but her difficulties with student debt are far from unique.

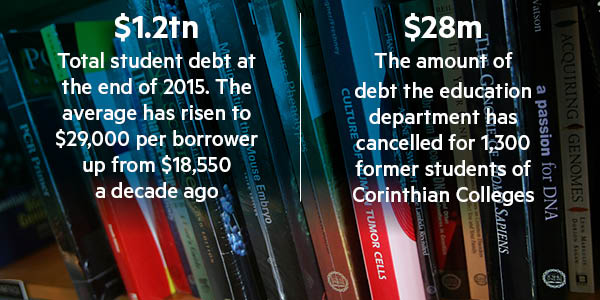

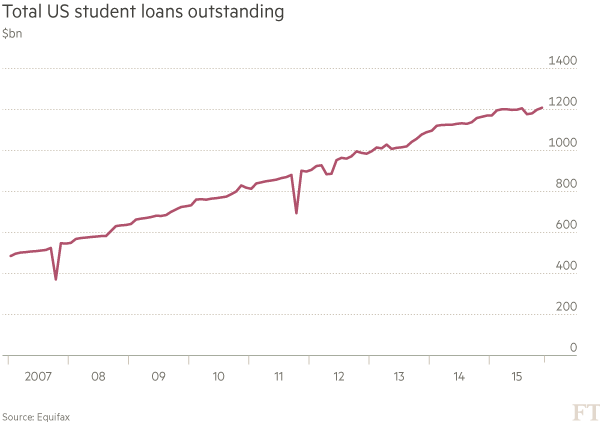

Americans had collectively built up $1.2tn of student debt by the end of 2015, more than triple the amount from a decade earlier. Many have borrowed heavily in the belief that continuing their education after high school is the best way of breaking free from the low-wage rut that has trapped millions during the economic recovery.

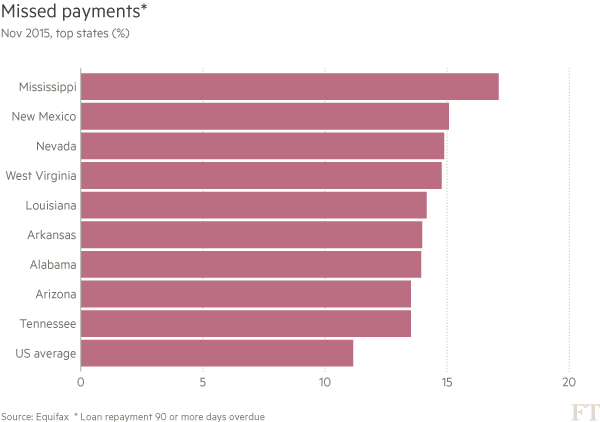

Some are now finding that the burdens outweigh the benefits. Student loans surpassed credit cards in 2012 as having the worst delinquency rates in consumer credit. More than one in 10 student loans were more than 90 days overdue as of November, according to credit analysts Equifax Inc. Adding to the concerns is research that suggests the biggest financial problems are faced by students who can least afford it: poorer Americans who took out smaller loans to pay for courses at less prestigious institutions.

Federal laws stop student debt from being discharged via bankruptcy in most cases, meaning the debts can drag on personal finances for years. This has triggered concern that the level of student debt, which averaged just under $29,000 per borrower in 2014, up from $18,550 a decade earlier, will hold back many Americans’ ability to start a business or buy a house.

To the Consumer Financial Protection Bureau, which was set up after the financial crisis as the primary regulator of education loans, the student debt situation bears hallmarks of the toxic mortgage loans that triggered the 2008 meltdown. Seth Frotman, acting student loan ombudsman at the CFPB, says: “We see a breakdown in student loan repayment eerily reminiscent of what we saw in the mortgage crisis.”

Unlike other forms of consumer debt, student loans are not covered by comprehensive rules on issues such as payment processing, complaints handling and how to help struggling borrowers, he says. “There is a generation of people straddled with unprecedented student debt. We see this impacting household balance sheets, and this has broader implications for the economy.”

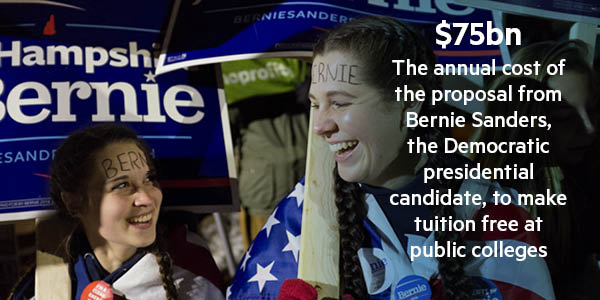

Political pressure

The Democrats Hillary Clinton and Bernie Sanders, and the Republican Marco Rubio, have made detailed plans to reform student borrowing a central part of their pitch in the presidential election campaign. For voters born after 1980, student debt and college affordability are the second most important issues facing the next president after the economy and jobs, according to a USA Today/Rock the Vote poll in January.

President Barack Obama’s administration has taken initiatives to lighten the burden on borrowers, including boosting grants for the less well-off, expanding programmes that adjust repayments according to the size of graduates’ salaries and creating a tax credit for education expenses.

It is also seeking to crack down on colleges that, it says, are profiting illegally from students, including those accused of running “recruitment mills” to enrol as many people as possible, regardless of their ability or likely success.

A central flashpoint in the student loan debate is the high prevalence of repayment problems at corporate-owned, for-profit colleges — run as businesses to make money for owners and shareholders — which in recent years have aggressively courted lower-income students. They differ from private non-profit colleges, which are funded partly by endowments and overseen by boards that have no financial stake in the institution; and public colleges, which receive a large portion of their funding from state and local tax revenue.

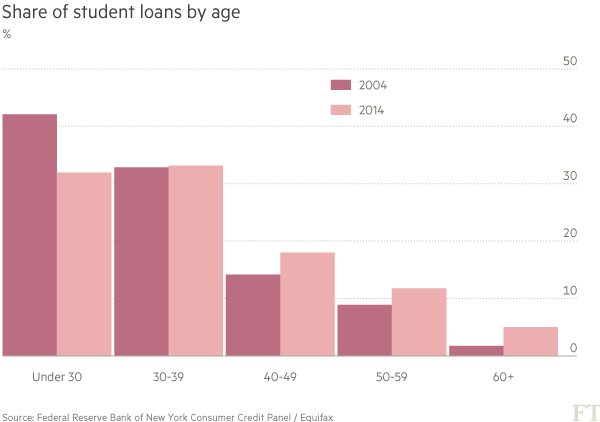

The US education department has created an enforcement unit to target institutions that lure students in with deceptive marketing, sign them up for courses for which they lack the skills, or request federal financial aid for them dishonestly. Ted Mitchell, undersecretary at the education department, says the number of vulnerable borrowers has risen partly because colleges are admitting more adult students, including single mothers and military veterans in their twenties and thirties.

“This tier of people tends to be lower income than the traditional middle-class student, whose parents drop them off in the family minivan at a two or four-year institution,” Mr Mitchell says. “So not only is more of the weight falling on students and families, but it’s falling on an increasingly less well-off population . . . and they don’t have the wealth buffer to fall back on.”

Seeking forgiveness

America’s student debt woes have their roots in the recession, which delivered a triple blow by forcing students to take on more borrowing, even as struggling states cut support for tuition and job opportunities diminished for graduates.

Under the US system, the federal government and states provide grants and loans to students, but state governments have cut funding in recent years. The federal government’s loans, which have low interest rates and do not require credit checks, go direct to students and are administered by the education department and funded by the Treasury.

For-profit colleges have flourished since the start of the 2000s by meeting demand for higher education that existing public and non-profit institutions could not satisfy. They offer convenience and flexibility for growing ranks of non-traditional students who do not have the grades for a four-year university course and may want to attend part-time while working.

Many of the colleges have come under mounting regulatory scrutiny and earnings pressure amid high student default rates and investigations into claims of aggressive marketing. Corinthian Colleges, one of the largest for-profit chains in the country with 16,000 students, last year filed for bankruptcy protection amid government allegations it misled students about their chances of getting a job. Corinthian did not admit any wrongdoing when the allegations were first aired and said it did not deserve to be forced to shut down when it announced its closure last April.

The education department has received almost 10,000 applications from students seeking to have their debt expunged under a federal law that forgives debt for borrowers who prove their schools used illegal methods to enlist them. So far it has agreed to cancel nearly $28m of debt for 1,300 former students of Corinthian Colleges.

At Westwood, the remaining students will transfer to other institutions after its closure, scheduled for Friday. The chain, owned by a private education company called Alta Colleges, which is majority owned by private equity firm Housatonic Partners, has previously been accused of using misleading tactics to recruit students. In 2012 the Colorado attorney-general reached a $4.5m settlement following allegations that the institution inflated job placement rates. Westwood made no admission of liability as part of that settlement.

In a statement announcing its closure, Westwood blamed declining enrolments on “market shifts and changes in the regulatory environment” and said it was proud of its achievements.

Luke Herrine, from the activist group The Debt Collective, is pushing for debt forgiveness by the education department. “Defaults are outrageously high among poorer Americans,” he says. He argues the rise of for-profit institutions has created a “problematic dynamic” among people of modest means and believe college will enhance their ability to move up the income ladder, yet leave their courses financially vulnerable.

Research by Adam Looney of the US Treasury and Stanford’s Constantine Yannelis bears out that concern. The report found that students who had exited a for-profit college or two-year college course in 2011 represented 70 per cent of defaults by 2013, and that they were more likely to be unemployed than those who left traditional universities. The borrowers with the biggest debts tend to have attended graduate schools or big-name universities, yet they are not the ones most likely to struggle to pay the debts off afterwards.

Data compiled for the FT by Equifax to track student loan delinquencies show that some of the largest problems are in poorer states. In Mississippi, some 17 per cent of student loans are overdue by more than 90 days, the highest in the country, followed by New Mexico at 15 per cent.

But defenders of for-profit colleges insist they are expanding opportunity, not squashing it.

Nate Clark, who runs the Career College of Northern Nevada, says the Obama administration is exaggerating the extent of bad practices in the sector.

“I think it does exist at a certain level; every segment of our economy has some type of corruption going on and we need to police it,” he says, but fears the education department’s probe could turn into a “witch hunt”.

He adds: “A lot of money is going to be spent on something and not going to produce a whole lot.”

Even those institutions trying to do the right thing struggle to keep students out of financial trouble. The current default rate among Mr Clark’s former pupils is 24.6 per cent, he laments, worryingly close to a 30 per cent threshold where the government can stop an institution’s students from accessing federal loans.

Pockets of crisis

The education department has identified “pockets of real crisis in student borrowing” but it believes these largely exist in places where students enrol in a programme and don’t complete it, says Mr Mitchell. He stresses that college continues to be a “great investment”, yielding oversized returns for people who complete anything from a four-year degree to a quick diploma.

Research bears that out. David Autor, a professor at Massachusetts Institute of Technology, has found that the earnings gap between the median college-educated US male and their counterpart with a high school education doubled between 1979 and 2012. The unemployment rate of Americans with a bachelors degree or higher was 2.5 per cent in January, as against 5.3 per cent for high school graduates who missed college.

As such, many Americans remain convinced the cost of a college education is worth it. Lafontant Williamson, who lives in South Carolina’s state capital Columbia, is one of them.

He says that while none of his friends are planning to go to college, he is applying for a place at university to study pharmacy, convinced that the gamble will pay off in a much higher salary than if he relied on a high school education.

“I would rather be in debt for 10 years and still eventually be making money,” he says. But he readily admits to having misgivings about the scale of the loans he could face. “It is a scary feeling.”

Comments