Eni discovers ‘supergiant’ gasfield near Egypt

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Italian energy group Eni has discovered what it says is a “supergiant” gasfield off the coast of Egypt, the largest ever found in the Mediterranean Sea and which could provide a much-needed boost for the country’s economy.

Eni, one of Europe’s biggest oil and gas companies, said on Sunday that the Zohr discovery “could become one of the world’s largest natural-gas finds” and would play a “major” role in meeting Egypt’s natural gas demand for decades once fully developed.

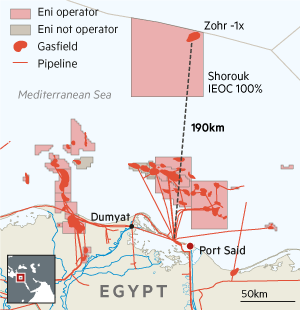

The field held a possible 30tn cubic feet of gas, or 5.5bn barrels of oil equivalent (boe), said the company, which has examined well results and geophysical data from the Zohr 1X NFW well located in 1,450 metres of water in the Shorouk exploration block. It covers an area of 100 square km, about 200km off the coast of Egypt.

Claudio Descalzi, chief executive of Eni, discussed the results with Egyptian president Abel Fattah Al-Sisi in Cairo on Saturday.

“It’s an exciting moment for us and also for Egypt,” he said. “This historic discovery will be able to transform the energy scenario of Egypt.”

“This brings potential relief to the country’s energy situation in terms of both availability and price,” said Mohamed Abu Basha, Egypt economist at EFG Hermes. “It is also potentially a source of foreign exchange.”

Mr Abu Basha said the size of the find was equivalent to 45 per cent of Egypt’s reserves.

The field could also give Europe a new supply option, lessening its dependence on imported Russian gas.

Mr Descalzi told the Financial Times that the find meant Egypt would not need to import gas for at least 10 years. “Egypt can rely on this discovery for the next decade. They have found a very important supply for the future.”

The field, he said, could hold as much as 40tn cubic feet of gas and oil that could yet be found with further exploration: “I think we can discover more.”

Eni would immediately appraise the field “with the aim of accelerating a fast-track development” that would use existing infrastructure.

A final investment decision could be made this year, with drilling likely in 2016 and first production following soon afterwards. Peak output could reach 2.5bn to 3bn cubic feet a day, or roughly 65 to 80m cubic metres a day, he added.

Such large oil and gas finds have become rare in recent years as companies have had to spend bigger sums on new technology to explore in hard to access deepwater areas and other higher cost regions.

US and European majors have had little to show for their efforts, the ‘Big Five’ of BP, Chevron, ExxonMobil, Royal Dutch Shell and Total shedding more than a billion barrels of reserves in 2014, according to figures in their annual reports, the sharpest decline in at least six years.

Figures from IHS, the research company, show discoveries of new oil and gas reserves dropped to their lowest level in at least two decades last year.

Eni, however, said that exploration had been central to its growth strategy. In the past seven years it had found 10bn barrels of resources and 300m in the first half of this year.

Eni, which has been active in Egypt since 1954 through its IEOC subsidiary, is the main oil and gas producer in the country, with equity production of 200,000 boe a day.

Additional reporting by Heba Saleh in Cairo

Comments