Shell’s £47bn swoop on BG Group opens way to wave of energy deals

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Royal Dutch Shell has swooped on its smaller rival BG Group, striking the energy industry’s biggest deal in more than a decade to extend its dominance of the global natural gas industry.

The £47bn deal excluding debt is the oil sector’s most dramatic response so far to the slide in the price of crude, which has slumped 50 per cent since last June. It could usher in further industry consolidation as energy companies scramble to cut costs.

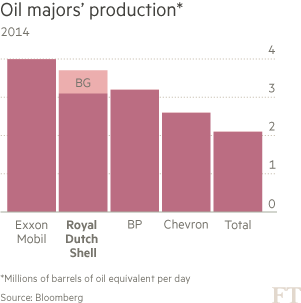

The BG takeover will increase Shell’s oil and gas reserves by a quarter and its production by 20 per cent. Analysts at Jefferies said that by 2018, Shell could be pumping more oil and gas than ExxonMobil, making it the world’s largest non-state oil company by output.

Key points of the deal

● See below

BG shares closed up 27 per cent at £11.53 in London. Shell’s B shares were down more than 8 per cent at £20.20, with some analysts suggesting Shell may have paid too much for BG.

However, Ben van Beurden, Shell’s chief executive, said the deal represented an “incredibly exciting moment” for the Anglo-Dutch major, which has struggled in recent years to boost production and increase its reserves.

Acquiring BG will turn Shell into the largest foreign oil company in Brazil, one of the world’s richest oil provinces, and strengthen its position as the largest producer and seller of liquefied natural gas among the global majors.

The deal comes at an awkward time for BG, which had just hired a new chief executive, Helge Lund, the former head of Norwegian oil major Statoil, to spearhead a wide-ranging turnround at the company.

Late last year, BG was forced to retreat in the face of a shareholder revolt over Mr Lund’s pay, more than halving his initial share award. Still, Mr Lund could receive as much as £28m for a term of office unlikely to extend beyond the year.

Mr van Beurden said Shell had long had its eye on BG but the recent fall in the oil price, which has dragged down the valuations of all the main energy groups, made a deal ”very compelling from a value perspective”. BG’s share price had fallen 28 per cent between last June and the announcement of Wednesday’s deal.

Shell will pay BG shareholders 383p a share in cash, plus 0.4454 B shares in Shell. That is equivalent to £13.50 a BG share and values BG’s equity at about £47bn. It is a premium of about 50 per cent based on 90-day trading volumes.

BG recorded net debt of £8bn at its last results, placing an enterprise value on the deal of almost £55bn.

Some Shell shareholders cautioned that by acquiring BG, Shell would be taking on some potentially troubled assets.

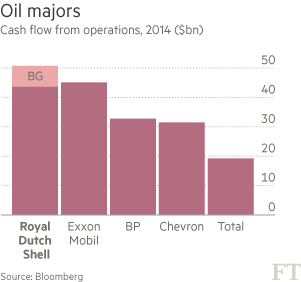

Matthew Beesley, head of global equities at Henderson Global Investors, which owns shares in Shell and BG, said: “Shell is taking on more risk and is issuing more shares and paying out cash to BG shareholders.

“As a result, their balance sheet will become more stretched. This potentially puts some strain on [Shell’s] dividend as they redirect cash flows to paying down debt ahead of growing the dividend.”

However, Michael Clark, portfolio manager of Fidelity MoneyBuilder Dividend Fund, a big investor in Shell and BG, stressed it was a good deal for both sets of shareholders. “There is no danger that Shell will change its dividend policy,” he said. The company confirmed it would maintain its current payout of $1.88 per ordinary share in 2015 and pay “at least that amount” in 2016.

Since the price of crude began to slide last year, expectations have been high that the oil sector could see a repetition of the mergers and acquisitions fever that reconfigured the industry in the late 1990s — another period of low oil prices — and led to the creation of the current crop of supermajors including BP, Chevron and ExxonMobil.

Some significant deals have already materialised since oil prices began to drop. Halliburton, the oil services group, unveiled plans last November to buy rival Baker Hughes. Repsol of Spain in December proposed a takeover of Talisman Energy of Canada. Rex Tillerson, chief executive of ExxonMobil, said last month the company could be open to a large deal.

Mr van Beurden first broached the deal in a March 15 call to Andrew Gould, BG’s chairman, who used to be chief executive of oil services company Schlumberger. “I called [him] up and we had a very good and constructive discussion,” the Shell CEO said.

Mr van Beurden acknowledged Shell would face questions from competition authorities in Australia, Brazil, China and Brussels, but so far it had not identified any “insurmountable issues”.

Shell was advised by Bank of America Merrill Lynch. BG was advised by Goldman Sachs and Robey Warshaw.

Key points of the deal

● Deal valued at £47bn excluding debt, 52% premium to 90-day average price

● BG shareholders receive per share: 383p cash, 0.4454 Shell B shares

● BG shareholders to own 19% of combined company

● Adds 25% to Shell’s proved oil and gas reserves

● Adds 20% to its production

● Annual pre-tax savings of $2.5bn

● Dividend of $1.88 a share

● $25bn buyback 2017-20

● Seeking clearance from competition regulators in UK, EU, China, Brazil and Australia

● BG directors unanimously recommend the deal

● Deal expected to be completed early 2016

● Shell expects asset sales to total $30bn in 2016-18

Additional reporting by Arash Massoudi

Back to the top of the page

Comments