Could record slide in crude oil price be ending?

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

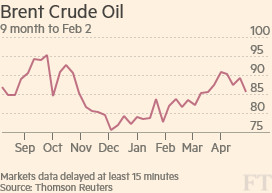

Oil set a record on Friday — it registered seven consecutive months of losses for the first time. In that period Brent, the international crude benchmark, has slumped by more than 50 per cent, taking the price to a six-year low.

But something else also happened. Brent posted its biggest one-day gain since 2009. Excitement over falling US rig counts saw Brent rise almost 8 per cent and finish above $50 a barrel.

Following two weeks of relatively stability, the question traders and analysts are asking themselves is whether oil has found a floor.

There are reasons for thinking the price may have bottomed.

First, US rig counts. Oil companies idled almost 100 last week, the biggest drop on record. Second, major producers such as Royal Dutch Shell and ConocoPhillips have slashed billions of dollars from their investment programmes. This has raised hopes that non-Opec supply will fall significantly this year, helping to balance the market.

At the same time, there are signs that demand is starting to respond to lower oil prices. US gasoline consumption, for example, has averaged more than 9m barrels a day for the past month, while total product demand has remained firmly above 20m b/d for the two weeks.

Bulls can also take heart from recent comments made by Opec Secretary General Abdalla El-Badri, who told a conference in London last week: “Maybe prices have reached a bottom”.

However, there are powerful reasons for thinking that prices have not found a floor and Friday’s spike might have been nothing more than a short covering rally. Indeed, its worth noting that hedge funds have built their largest short in West Texas Intermediate — the US oil benchmark — since November 2010.

One reason for sceptism is that global growth is sluggish. The IMF recently cut its global economic growth forecasts by 0.3 percentage points for both 2015 and 2016 in spite of the “shot in the arm” from oil prices.

“Too many companies and households keep cutting back on investment and consumption today because they are concerned about the growth tomorrow,” said Christine Lagarde, managing director of the IMF.

And while US rig counts are falling, US domestic production is still rising — it reached a 31-year high of 9.2m b/d last week. Many analysts believe the oil price needs to trade around $40 a barrel to slow supply growth and keep capital investment in shale sidelined. US commercial crude stocks are also increasing. They rose to their highest level since 1931 last week and currently stand at 44 days of production.

Also, headline rig counts might look impressive but as analysts at Morgan Stanley point out much of the drop has come in low yielding vertical/directional rigs — ie. low-hanging fruit.

But most importantly there is no sign of Opec, or its de facto leader Saudi Arabia, changing policy and lowering its production target of 30m barrels a day. Indeed, Mr Badri said last week that Opec was “not the cause” of the supply glut “so we are not cutting”.

In fact, some members of the cartel are even increasing production. According to a Reuters survey Opec production averaged 30.37m barrels a day in January as Angola and the cartel’s other west African member, Nigeria increased output. Supply from Saudi Arabia and other Gulf producers was also steady.

The Commodities Note is an online commentary on the industry from the Financial Times

Comments